Credit Card Service Tax Rm25 Waiver

Finance minister lim guan eng through his powers under the service tax act 2018 announced the service tax amounting to rm25.

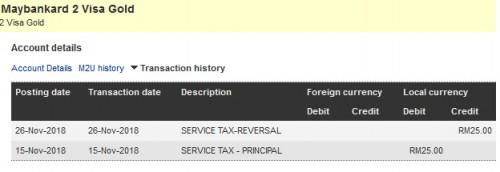

Credit card service tax rm25 waiver. However you may opt to pay the annual service tax using your maybank treatspoints or membership rewards sm points once the service tax is charged into your card account. However this could lead to a drop in the number of credit and charge cards being used just as it did the last time such a tax was introduced. Find out more about service tax. Effective 1 september 2018 rm25 service tax will be imposed on each principal and supplementary credit card as per the following.

All principal cardholders will have to pay rm25 yearly for each credit or charge card issued to him her while supplementary cardholders will have to pay rm25 yearly for each credit or charge card issued. Service tax of rm25 will be charged on each new primary and supplementary credit cards upon activation of the credit card. In an order that was made just days before the revived sales and services tax sst regime kicked in on september 1 finance minister lim guan eng through his. The existing effective period of the card will not be subject to service tax of rm25 until the next annual renewal.

In other words the service tax of rm25 on each credit or charge card that an individual owns will be charged upon renewal of the card. Under sst 2 0 the rm25 charge will be applied to each credit or charge card regardless if it is a principal or supplementary card. Principal card rm25 per card per year supplementary card rm25 per card per year. Kuala lumpur aug 30 a service tax of rm25 will be imposed on either new credit card users or those who renew their credit cards from september 1 onwards the finance minister has ordered.

This service tax is effective 1 september 2018. B new card approved from 1 september 2018 on the card activation date of each card. Service tax implementation effective 1 september 2018 service tax will be imposed on selected products and services only. Service tax of rm25 will be imposed on each principal and supplemantary cimb credit cards upon activation and annual renewal of the principal and supplementary credit card.

Credit card holders will be charged with an annual rm25 service tax which is expected to contribute an additional rm225 million to the national revenue. It should be noted that the amount is less compared to the old service tax model. Service tax waiver is not allowed as this is a regulation governed by service tax act 2018. For existing credit cardholders service tax of rm25 will be charged on the anniversary month of each of your primary and or supplementary credit cards.

A service tax of rm25 is imposed upon activation of new principal or supplementary cards and on the anniversary renewal date every year including on existing cards in issuance as at 1 september 2018 i e.