Goods And Services Tax Act 2017 Upsc

Tax slabs are decided as 0 5 12 18 28 along with categories of exempted and zero rated goods for different types of goods and services.

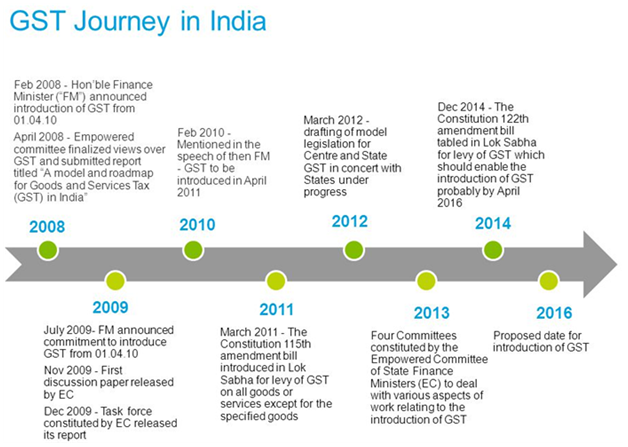

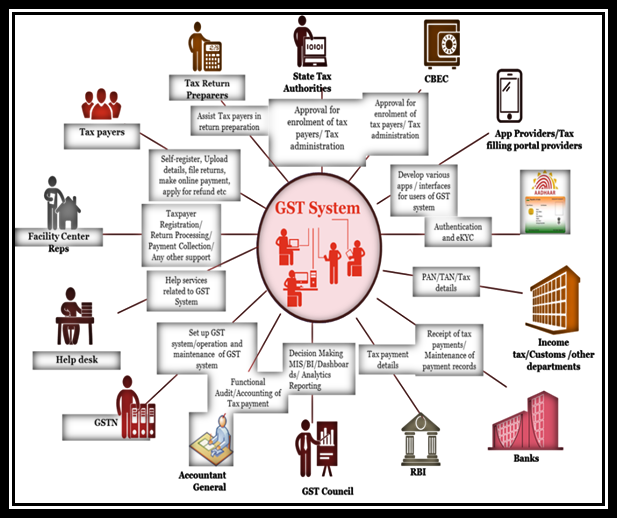

Goods and services tax act 2017 upsc. Goods and services tax gst act came into effect in 2017. 3 it shall come into force on such date as the central government may by notification in the official gazette appoint. Gst launched in india on 1 july 2017 is a comprehensive indirect tax for the entire country. Provided that different dates may be appointed for different provisions of this.

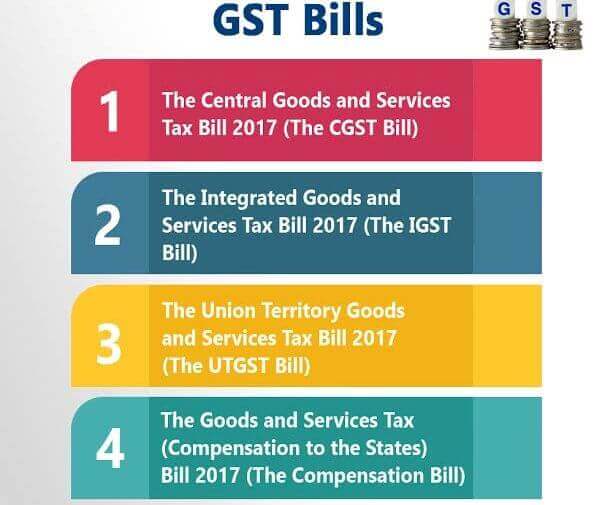

The union territory goods and services tax bill 2017 the utgst bill. A 1 only b 2 and 3 only c 1 2 and 4 only d 1 2 3 and 4. Comptroller means the comptroller of goods and services tax appointed under section 4 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by section 5 2 a deputy comptroller or an assistant. It was introduced to save time cost and effort.

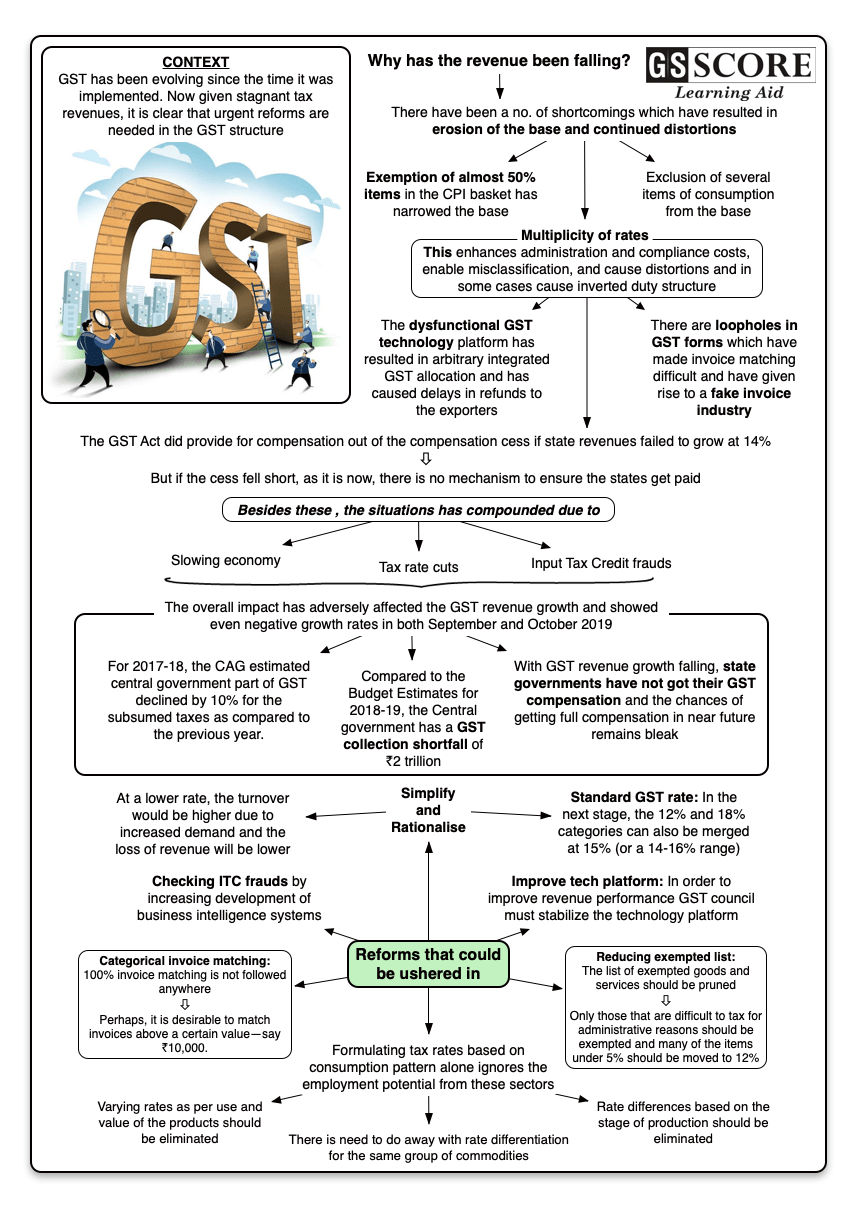

This promise convinced a large number of reluctant states to sign on to the new indirect tax regime. 2 it extends to the whole of india except the state of jammu and kashmir. 12 of 2017 12th april 2017 an act to make a provision for levy and collection of tax on intra state supply of goods or services or both by the central government and for matters connected therewith or incidental thereto. And a state gst will be passed by the respective state legislative assemblies.

Gst being a consumption based tax would result in loss of revenue for manufacturing heavy states. 1 this act may be called the central goods and services tax act 2017. Which of the above items is are exempt under gst goods and services tax. The goods and services tax compensation to the states bill 2017 the compensation bill.

A 1 only b 2 and 3 only c 1 2 and 4 only d 1 2 3 and 4. Gst launched in india on 1 july 2017 is a comprehensive indirect tax for the entire country. The central goods and services tax act 2017 no. Which of the above items is are exempt under gst goods and services tax.

With gst a large number of central and state indirect taxes merged into a single tax. The gst became applicable from 1 st july 2017 after the enactment of the 101 st constitution amendment act 2016. Cgst central goods and service tax sgst state goods and service tax igst integrated goods and services tax. An act to make a provision for levy and collection of tax on intra state supply of goods or services or both by the central government and for matters connected therewith or incidental thereto.

In order to address the complex system in india the government introduced 3 types of gst which are given below. S union territories goods and services tax act means the union territories goods and services tax act 2017. The centre promised compensation to the states for any shortfall in tax revenue due to gst implementation for a period of five years. Gst being a consumption based tax would result in loss of revenue for manufacturing heavy states.

12.png)