Goods And Services Tax Australia

Australia exempts the following goods from the 10 vat.

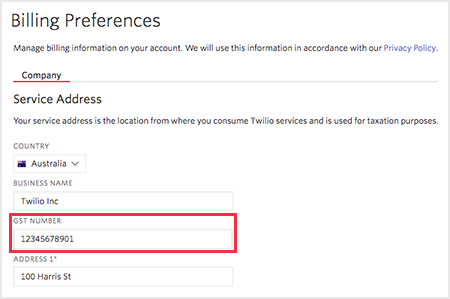

Goods and services tax australia. Vat rebates for exported goods and gst taxed business goods are also available. As a business you use a business activity statement to report and pay the goods and services tax gst your business has collected and claim gst credits. Australia s goods services tax gst is a heavy tax for many small businesses but those amazon sellers with an australian address can get a 10 tax waiver. Labels g1 g2 g3 g10 g11 g21 g22 g23 g24 1a and 1b.

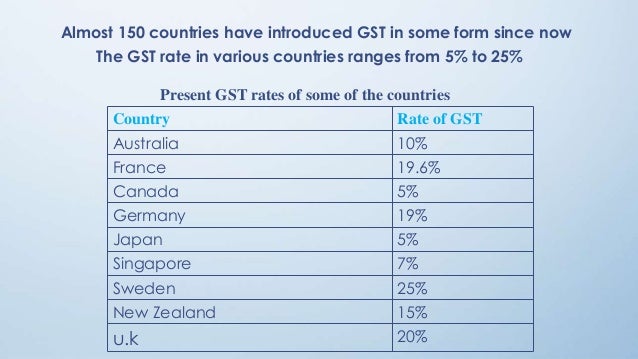

Goods and services tax gst is a broad based tax of 10 on most goods services and other items sold or consumed in australia. This includes things bought in shops as well as dining out. Fresh food medical services medicines and medical devices water and sewerage education services childcare government taxes permits precious metals second hand goods and more. Goods and services tax gst in australia is a value added tax of 10 on most goods and services sales with some exemptions such as for certain food healthcare and housing items and concessions including qualifying long term accommodation which is taxed at an effective rate of 5 5 gst is levied on most transactions in the production process but is in many cases refunded to all parties.

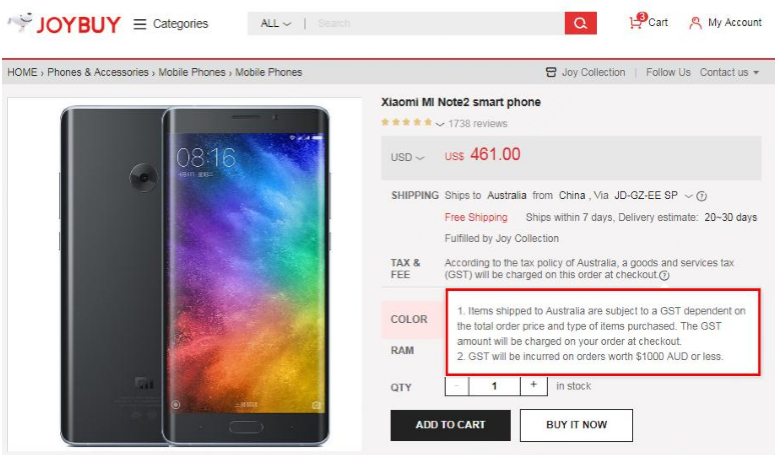

Attend our gst webinar to help you to understand gst and its implications for business. In december 2017 amazon launched its online presence in the land down under although the kick off was slow in the last couple of months australia s e commerce has gained momentum. Most goods in australia are subject to a 10 gst goods services tax. Most businesses report and pay their gst quarterly and have a choice each year about how they do this.

.jpg)