Gst Vs Sst Malaysia Pdf

The newly elected government has promised to replace gst with sst making malaysia the first country in the world that reverses the path of tax reform.

Gst vs sst malaysia pdf. The service tax was governed by the service tax act 1975 and this was also a federal consumption tax. The focus will be on the implementation of gst and new sst in malaysia from different stakeholders perspective results. Sales tax and service tax sst framework deloitte analysis and views overview the proposed taxes are conceptually a re introduction of the sales tax and service tax that existed prior to the introduction of gst but with some changes in its scope and also its administrative and compliance aspects. The sales tax in malaysia was a federal consumption tax that was introduced and implemented on a wide variety of goods and governed by the sales tax act 1972.

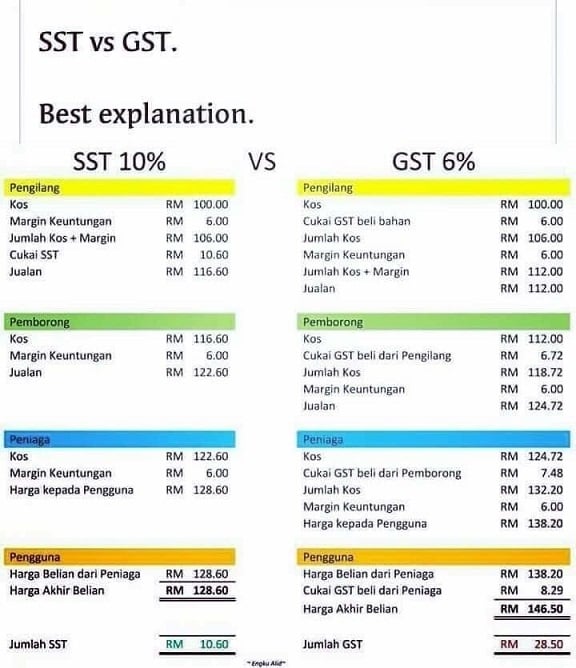

Malaysia s decision to revert to the sales and service tax sst from the goods and services tax gst will result in a higher disposable income due to relatively lower prices it will incur in. Gst vs sst 2018 gsta2014 sst 2 0 gst act 2014 act 762 sales tax act 2018 act 806 service tax act 2018 act 807 tax on supply anything done for consideration tax on business transaction scope of taxation. Download file pdf read file. What is the impact of the change of gst to sst in malaysia.

To put it simply the sst consists of two separate taxes that are governed by two distinct tax laws on goods and services at a single stage. Taxable goods manufactured imported goods. Sst rates are less transparent than the gst which had a standard 6 rate the sst rates vary from 6 or 10. The results indicate that sst is much better to match with the malaysian.

Sst will usually see lower retail rates but there may be a possible increase in certain products including the costs or charges for the services provided. Supply made in malaysia where the supplier belongs scope of taxation. This means that businesses must continue to process and report gst and fulfil all compliance requirements including registering for gst issuing invoices using correct tax codes and submitting tax returns. Malaysia s gst vs sst knowing the difference.

Goods and services tax gst gst covers everyone retailers and trades. Sales tax is based on the cost of producing or importing products so whether it is imposed on the previous tax rate of up to 10.