How To Calculate Ss Total

It then caps those adjusted incomes at the taxable.

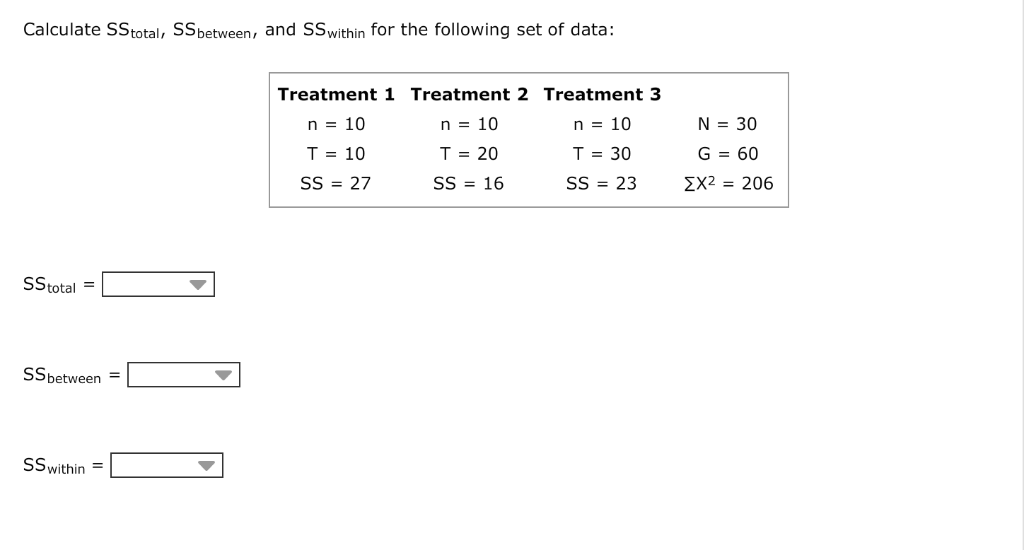

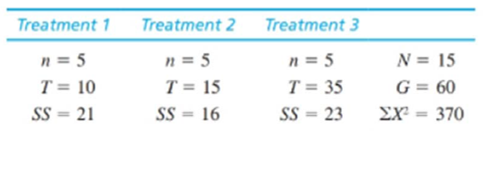

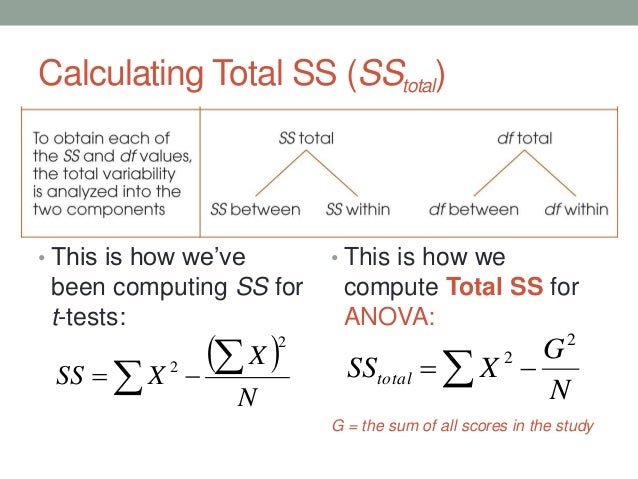

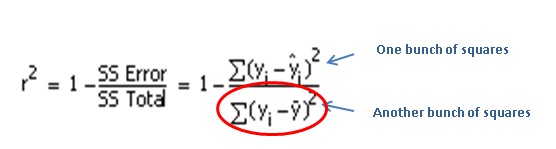

How to calculate ss total. Instead it will estimate your earnings based on information you provide. And you could view it as really the numerator when you calculate variance. This simple calculator uses the computational formula ss σ x2 σ x 2 n to calculate the sum of squares for a single set of scores. You can think of this as the dispersion of the observed variables around the mean much like the variance in descriptive statistics.

This is done to account for the rise in the standard of living during your working years. Just add your scores into the text box below either one score per line or as a comma delimited list and hit calculate. Ss sum of squares total. To calculate your aime the administration takes each year s income throughout your working life and adjusts it for inflation indexing.

So benefit estimates made by the quick calculator are rough. First we take your annual income and we adjust it by the average wage index awi to get your indexed earnings. We calculate this sums of squares using the squared scores x 2 in the table below. So you re just going to take the distance between each of these data points and the mean of all of these data points square them and just take that sum.

It is a measure of the total variability of the dataset. The first sums of squares that we always estimate is the sums of squares that serves as the foundation of our estimate of the variance of all of the scores in the data set ss total. The mean of the sum of squares ss is the variance of a set of scores and the square root of the variance is its standard deviation. For security the quick calculator does not access your earnings record.