How To Submit Gst Return

A 15 digit gst identification number will be issued based on your state code and pan number.

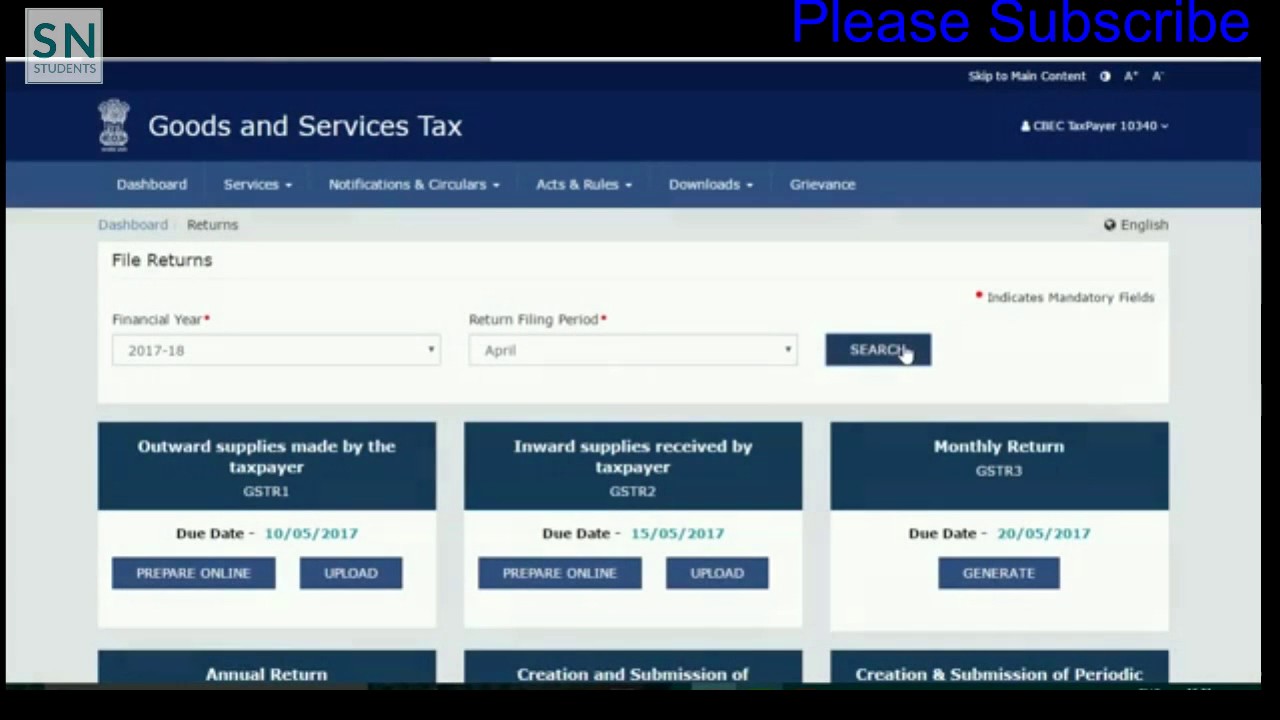

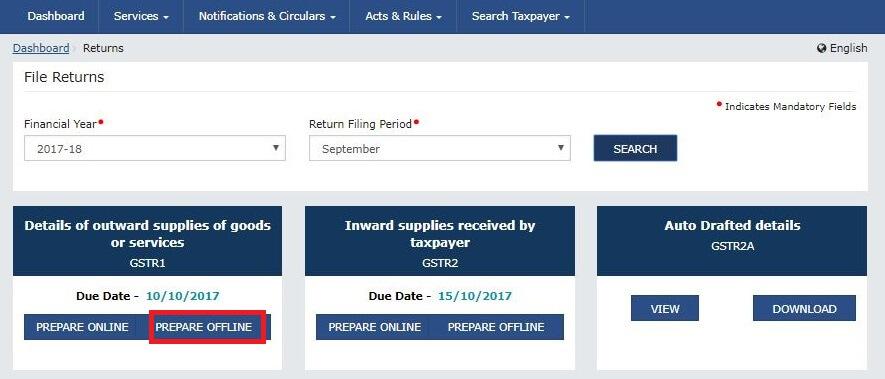

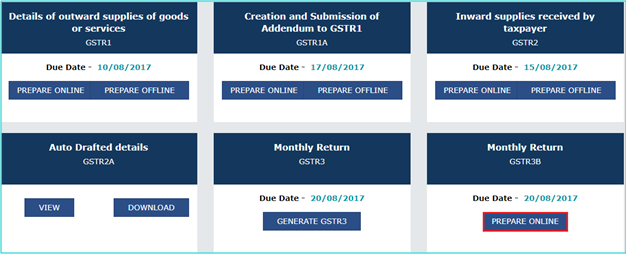

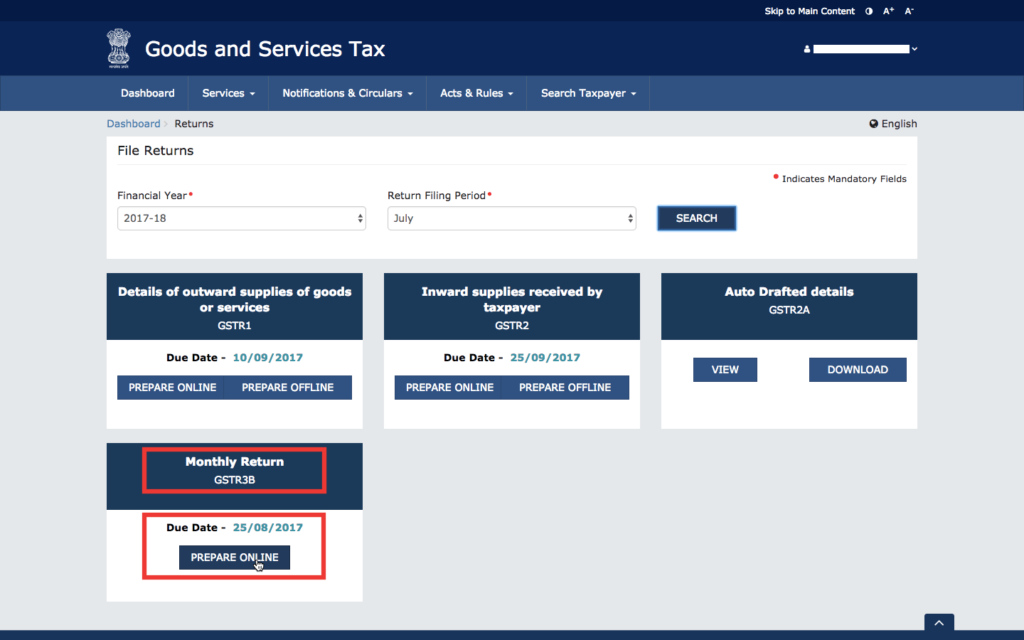

How to submit gst return. New boxes in gst return. You report and pay gst amounts to us and claim gst credits by lodging a business activity statement bas or an annual gst return. Tracking return status. Visit the gst portal www gst gov in.

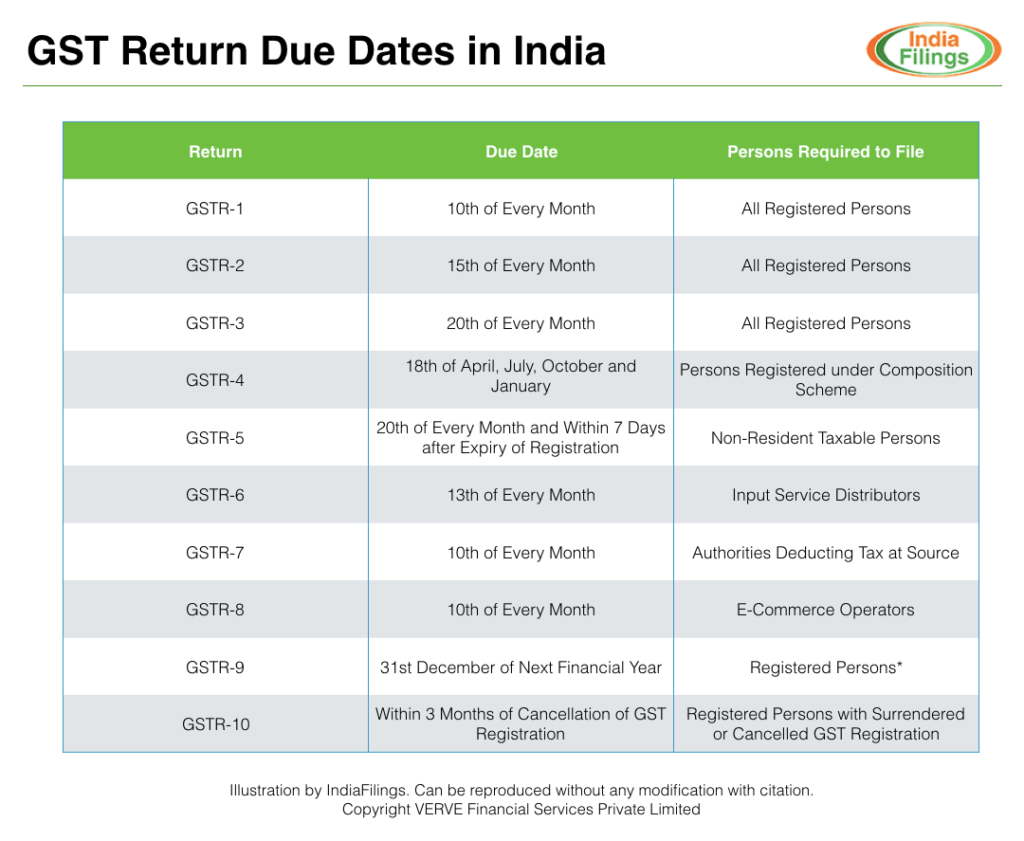

Your gst return and payment is due for the taxable period ending 31 october. Gst registered businesses are required to use corppass to e file their gst returns through mytax portal and make payment to iras by the due date. Watch this training kit to know complete process of viewing and tracking returns. In this video we will discuss the various.

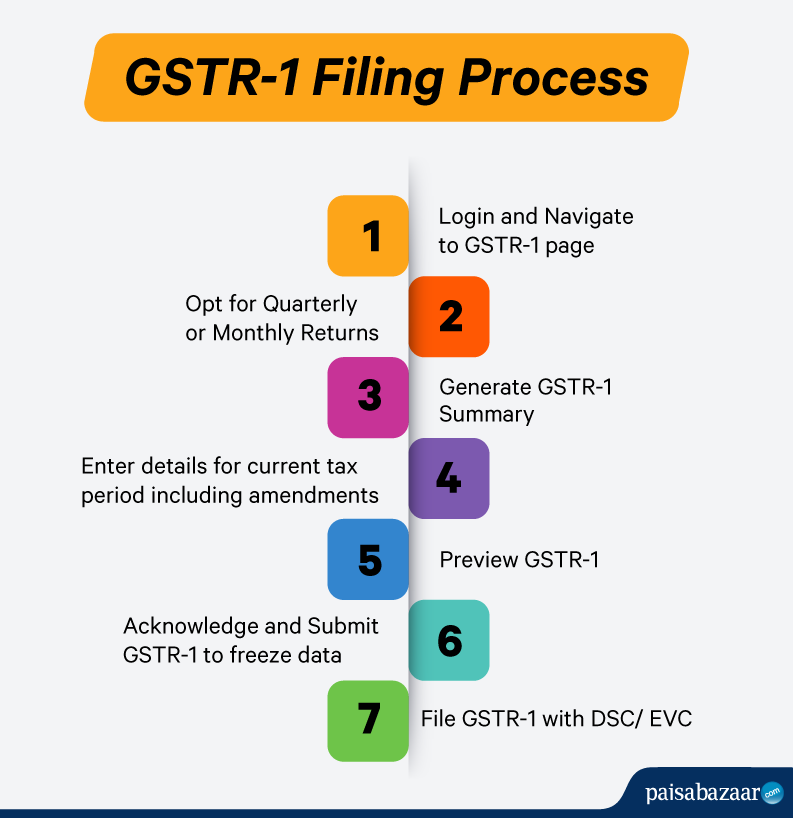

How to file gst returns online. Your gst return and payment is due for the taxable period ending 30 september. An invoice reference number will be issued against. Filing form gst cmp 08 quarterly statement for payment of self assessed tax by composition taxpayer fy 2019 20 onwards user manual.

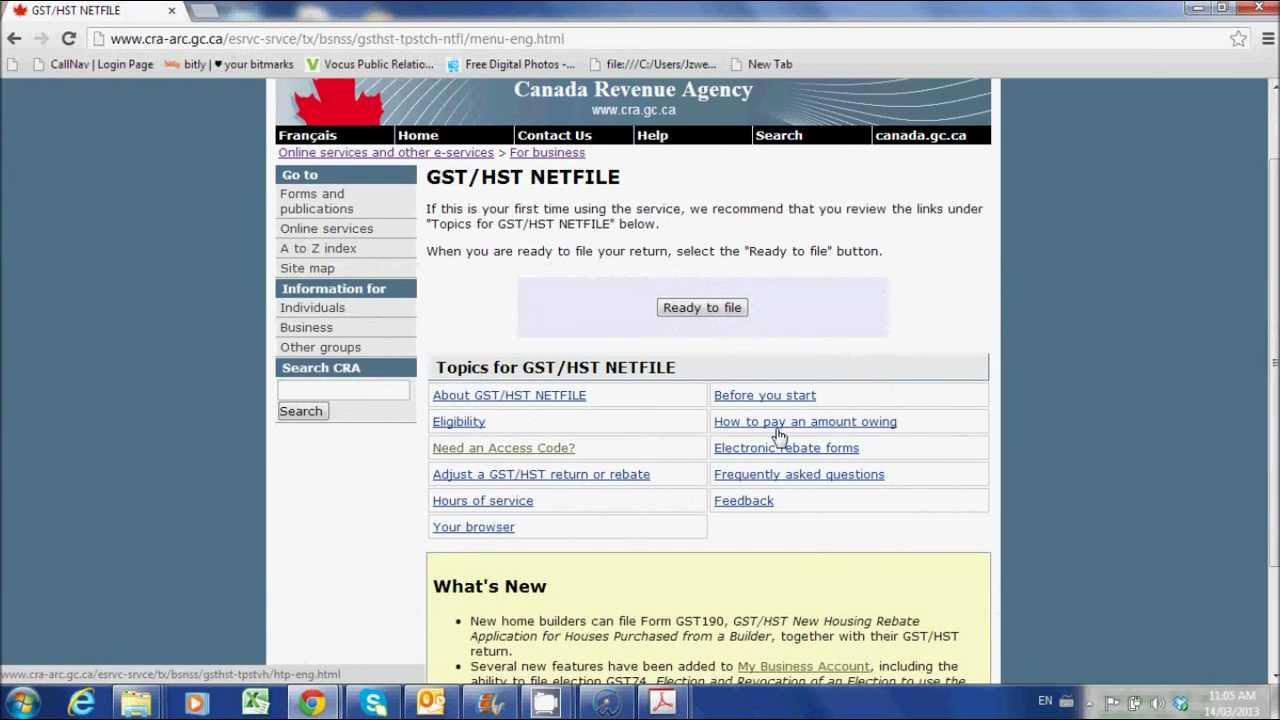

We issue your business activity statement about two weeks before the end of your reporting period which for gst is usually every three months. Here are the features of each method. You are also required to complete and submit a gst hst return. My business account represent a client.

File gst returns for period ending apr 2020 by 11 jun 2020. All gst dates. Authorise users for gst e filing. Your gst return and payment is due for the taxable period ending 31 august.

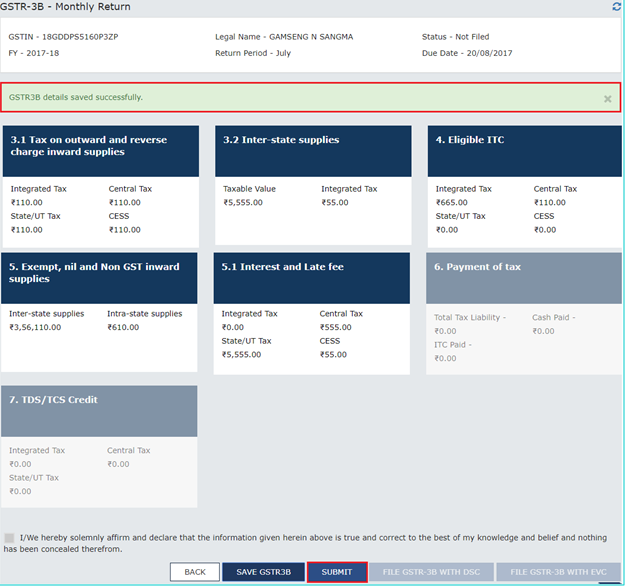

Depending on your business you may have to submit a return monthly quarterly or just one a year. You can view and track returns filed on the gst portal. Whatever the time frame any gst hst amounts that you have collected are funds that you have taken from someone in trust for the crown and must be remitted to the cra along. File your gst hst return form gst34 file your combined gst hst and qst return form rc7200 file any applicable schedules with your return.

Lodging your bas or annual gst return. Please share this video to our friends. Hi friends learn how to add tax invoice to our gst portal by this video. If you need a new return package or access code do one of the following.