How To Submit Gstr 3b Nil Return

In this article i have explained how to file gstr 3b online in easy steps.

How to submit gstr 3b nil return. Return acknowledgment number received. Access the www gst gov in url. Return filed validation successful. Return filed validation successful.

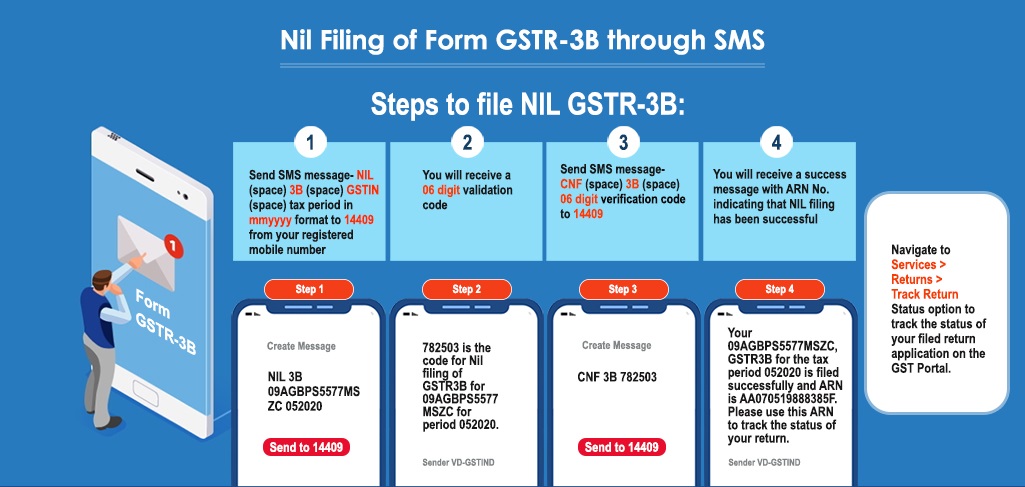

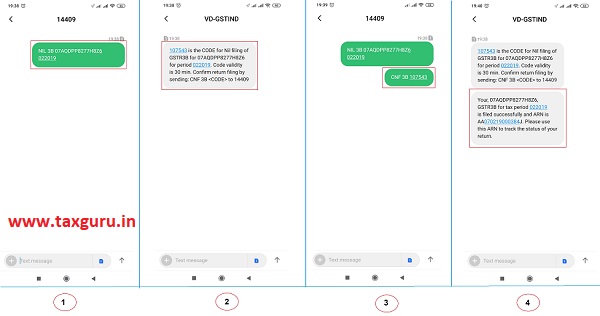

Cnf space 3b space confirmation code send to 14409. The gst home page is displayed. Confirmation code valid for 30 minutes. Filing of form gstr 3b is mandatory for all normal and casual taxpayers even if there is no business activity in any particular tax period.

A taxpayer may now file nil form gstr 3b through an sms apart from filing it through online mode on gst portal. Return acknowledgment number receive on same mobile number. Preview and submit gstr 3b. Enter login id and password3.

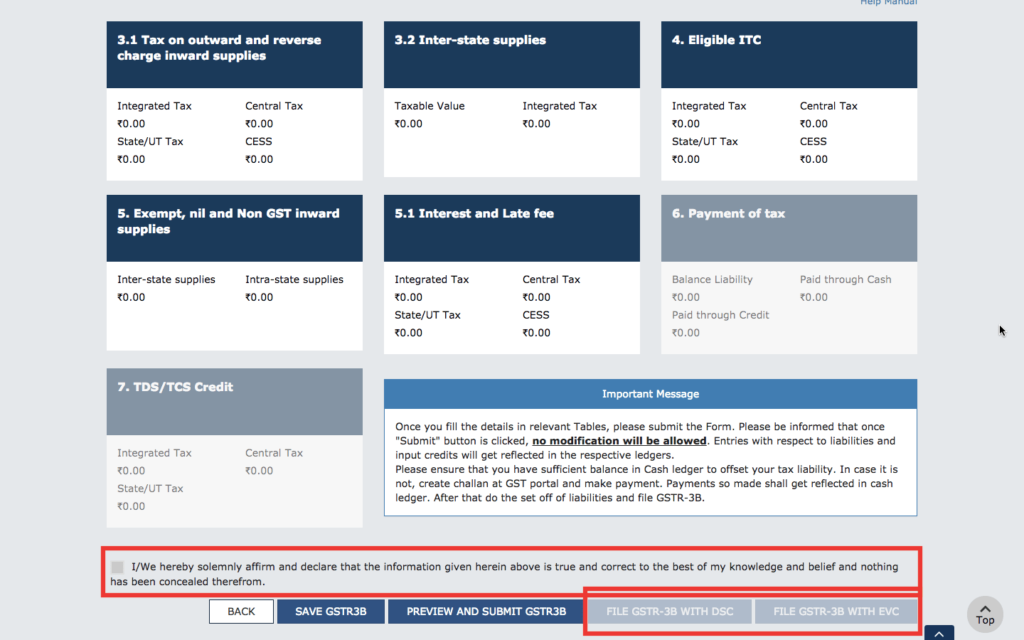

Gstr 3b is simple and easy to file but just be careful where the amount is to be entered. Step 1 go to gst portal www gst gov in. Once the gstr3b return is submitted tap on the agree checkbox and carefully sign the gstr3b come back to finish the nil gst return filling. Type in the sms nil space 3b space gstin space tax period.

Login to the gst portal with valid credentials. Steps to file gstr 3b return online. How to file nil gstr 3b gstr 3b live filing for no sale no purchase cases nil gstr 3b live filing many of you requested me for gstr 3b nil return video so. Six digit confirmation code received on same mobile number.

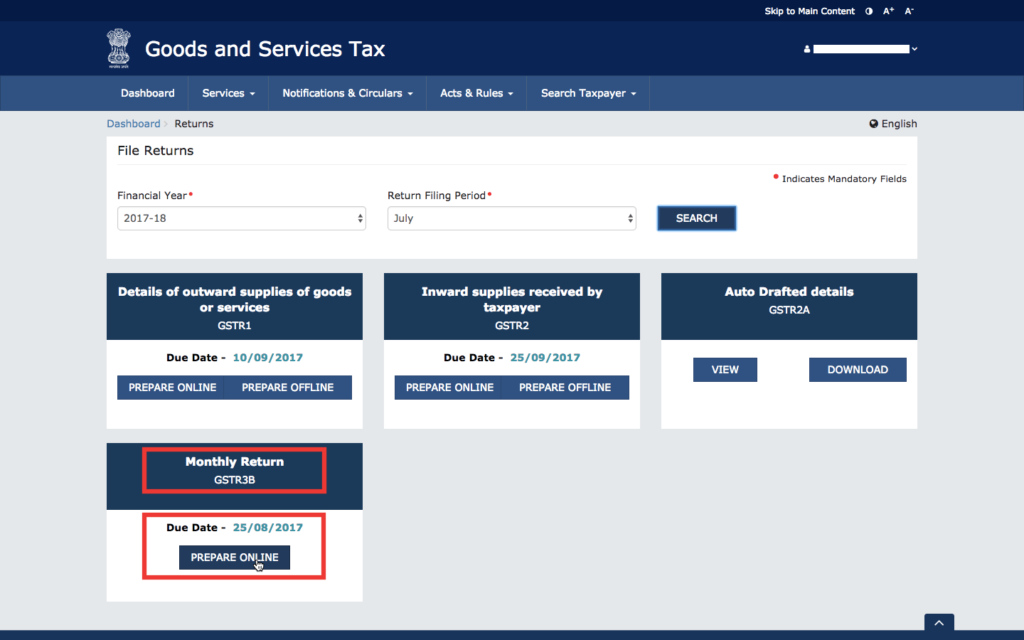

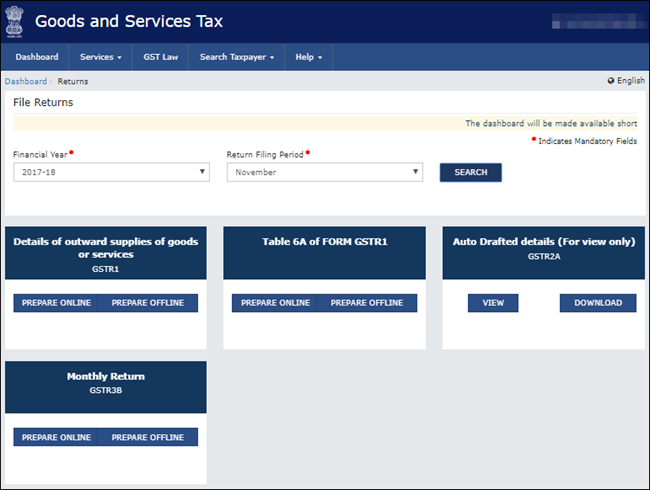

Send the sms to 14409. Click the services returns returns dashboard command. Select the financial year return filing period month for which you want to file the return from the drop down list. Once the catch is clicked the citizen won t have the capacity to change any of the data submitted.

Click yes button then click next6. It must be noted that one cannot amend gstr 3b and dealers must file separate gstr 3b for each of their gstin. Login and navigate to gstr 3b monthly return page. Following conditions must fulfilled to file nil form gstr 3b through sms.

Access the www gst gov in url. They must make it a point to pay the gstr 3b s tax liability by the last date of filing gstr 3b for the same month. Enter payment details in section 6. Tap on affirm and submit to document the gstr3b return.

The file returns page is displayed. The gst home page is displayed. Return filing period click search then click prepare online button5.