How To Submit Sst Malaysia Online

To declare sst return simply go to tax return under the tax module by navigating through.

How to submit sst malaysia online. To view the status of your payment request. Payment status history to view the status and detail of your online payment payment receipt to print the receipt for the payment you have made. 22 jalan ss 6 3 kelana jaya 47301 petaling jaya selangor. And b the complete form must be posted to the following address.

To print your official payment receipt. Ii apply online exemption schedule b. This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst. You must submit your tax return electronically via https mysst customs gov my and payments can be made after return submission in the same portal via fpx facility with 17 banks to choose from.

How to apply online exemption schedule b video link i sign up for non registrant. Customs processing centre cpc jabatan kastam diraja malaysia kompleks kastam wpkl no. 5 to update license profile. The move of scrapping the 6 gst has paved the way for the re introduction of sst 2 0 which will come into effect in 1 september 2018.

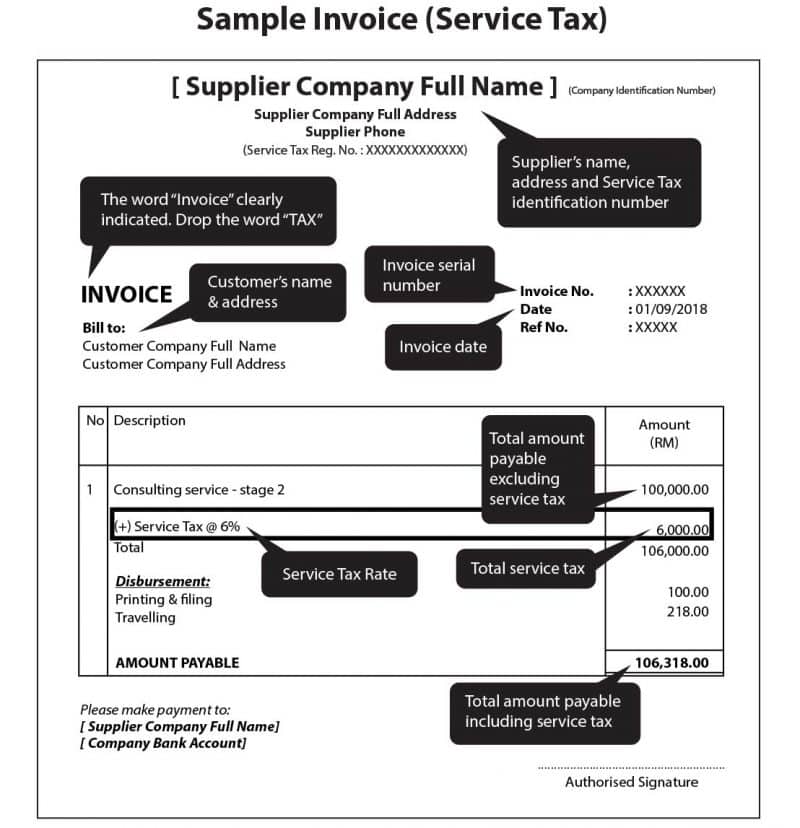

Payment payment request to select all the sst submission for online payment. Reminder list of reminder sent by system to user to submit the sst return. Sales and service tax sst return submission and payment companies have to declare sst return sst 01 every 2 months bi monthly according to the taxable period. Sales and service tax sst in malaysia.

To pay the sales tax return using online payment gateway. Sst return has to be submitted not later than the last day of the following month after the taxable period ended. Please click the new declaration button the screen for list of sst return. Tax sst sst return.

Then select taxable period and click on process at the next screen as shown below. A download sst 02 from portal mysst and type in by using capital letter. To submit sales tax return. To view sales tax license information and sales tax return schedule.

To view historical paid penalty record.