Income Tax Act 1967 Section 39

Rujukan kepada akta cukai pendapatan 1967 yang mengandungi pindaan terkini yang dibuat oleh akta kewangan 2017 akta 785 boleh diakses melalui portal rasmi jabatan peguam negara di pautan berikut.

Income tax act 1967 section 39. 2 the money of the fund referred to in subsection 1 shall be applied for the making of a refund of an amount of tax paid in excess of the amount payable as ascertained in section 50. Classes of income on which tax is chargeable 4a. Charge of income tax 3 a. Income tax act part.

Income tax act 1967 part i preliminary section 1. 39 1 for the purpose of assessing tax chargeable under schedules a and b the secretary clerk or person acting as such to a rating authority shall when required by the revenue commissioners transmit to them at the head office of the revenue commissioners in dublin true copies of the last county rate or municipal rate made by the authority for its rating area or any part thereof. Interpretation part ii imposition and general characteristics of the tax 3. Akta cukai pendapatan 1967 is a malaysian laws which enacted for the imposition of income tax.

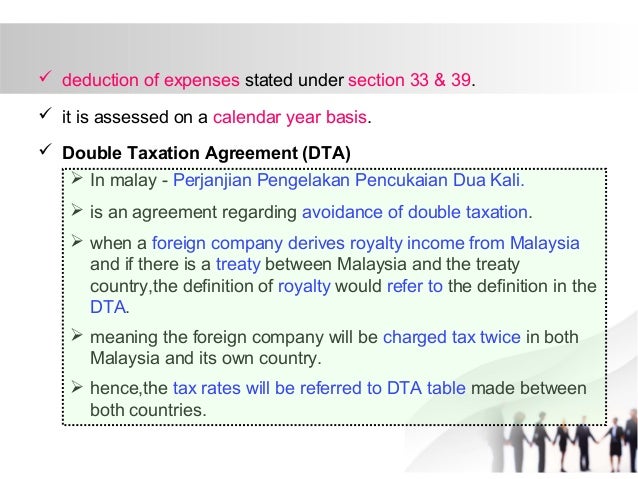

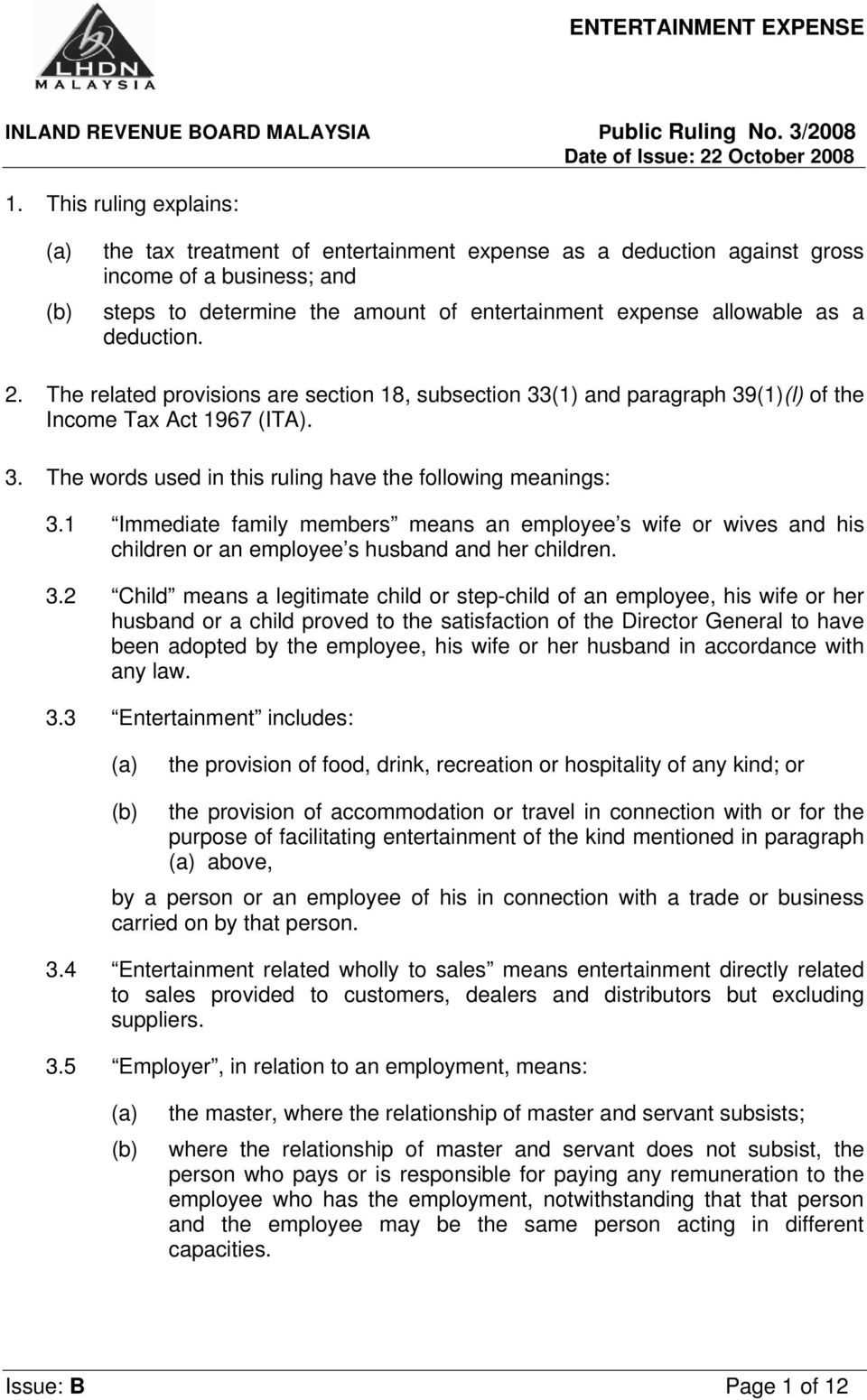

The income tax act 1967 in its current form 1 january 2006 consists of 10 parts containing 156 sections and 9 schedules including 77 amendments. 39 1 for the purposes of this act a a taxpayer s capital gain for a taxation year from the disposition of any property is the taxpayer s gain for the year determined under this subdivision to the extent of the amount thereof that would not if section 3 were read without reference to the expression other than a taxable capital gain from the disposition of a property in paragraph 3 a and without reference to paragraph 3 b be included in computing the taxpayer s income. Chapter 4 adjusted income and adjusted loss section. The related provisions are section 18 subsection 33 1 and paragraph 39 1 l of the income tax act 1967 ita.

Classes of income on which tax. Act 53 income tax act 1967 arrangement of sections part i preliminary section 1. Akta cukai pendapatan 1967 akta cukai pendapatan 1967 versi dalam talian pada 1 januari 2019 atau akta cukai pendapatan 1967 salinan. Special classes of.

1 subject to any express provision of this act in ascertaining the adjusted income of any person from any source for the basis period for a year of assessment no. Non chargeability to tax in respect of offshore business activity 3 c. The income tax act 1967 malay. In exercise of the powers conferred upon him by section 154 1 b of the income tax act 1967 the minister of finance hereby makes the following rules.

Short title and commencement 2. Short title commencement and interpretation 1 1 these rules may be cited as the income tax capital allowances and charges. Part iii ascertainment of chargeable income chapter. A the tax treatment of entertainment expense as a deduction against gross income of a business.

Short title and commencement 2. Charge of income tax 3a deleted 3b. Non chargeability to tax in respect of offshore business activity 3c deleted 4.