Input Tax Credit Under Gst Pdf

Input tax credit to be availed by a registered person in respect of invoices or debit notes the details of which have not been uploaded by the suppliers under sub section 1 of section 37 shall not exceed 10 per cent w e f.

Input tax credit under gst pdf. Section 16 to section 21 of the gst act 2017 passed on 12th april 2017 comprehensively discuss the provisions relating to the input tax credit. Reference to wbgst act 2017 includes reference to cgst act 2017 also. Input tax credit. 9 1 itc is core provision of gst input tax credit itc is the core concept of gst as gst is destination based tax.

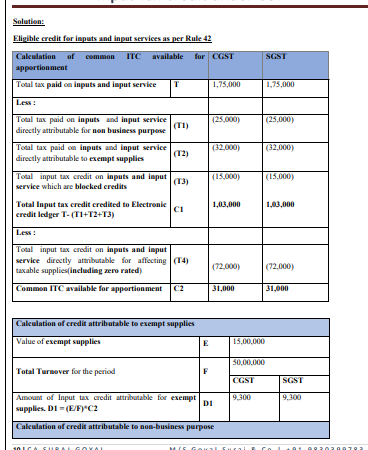

According to section 17 the input tax credit is available only to the extent of the goods or services used for the business purpose or effecting taxable supplies including zero rated supplies as discussed earlier in rule 42 43. Itc avoids cascading effect of taxes and ensures that tax is collected in the state in which goods or services or both are consumed. Cma bibhudatta sarangi dgm f a. Cascading of taxes in simple language is tax on tax.

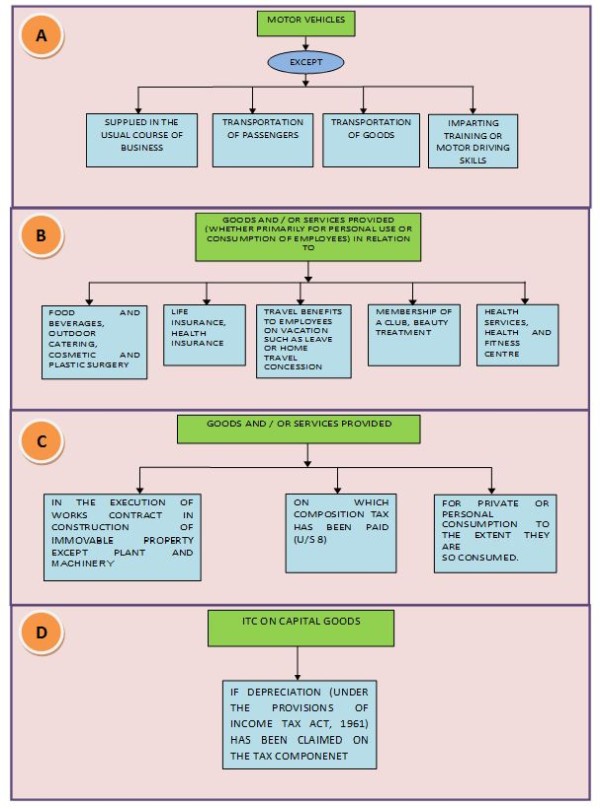

Input tax credit mechanism in gst uninterrupted and seamless chain of input tax credit hereinafter referred to as itc is one of the key features of goods and services tax. Input tax has been defined under gst law. Apart from the above there are goods and services which are not eligible for input tax credit have been listed out under section 17 5 as below. The balance rs 5 400 is paid to the govt.

Input tax credit itc under gst directorate of commercial taxes west bengal note. In this article we have covered common questions regarding input tax credit under gst regime. 2 the amount of input tax credit referred to in sub rule 1 shall be added to the output tax liability of the registered person for the month in which the details are furnished. Ne of the much talked about feature of goods and services tax act gst is seamless input tax credit.

Similarly when garv sells goods to ananya he collects rs 45 000 as gst from garv. And the amount of input tax credit availed of in form gstr 2 for the month immediately following the period of 180 days from the date of issue of invoice. 1 what is input tax. Answer is only for educational and guidance purposes and do not hold any legal validity.

Itc is a mechanism to avoid cascading of taxes. Under the present system of taxation credit of. Since garv had paid gst on inputs he can claim an input tax credit of an amount equal to the gst paid on the inputs i e. Input tax in relation to a taxable person means the igst and cgst in respect of cgst act and igst and sgst in respect of sgst act charged on any supply of goods and or.