Sale And Service Tax Act 2018

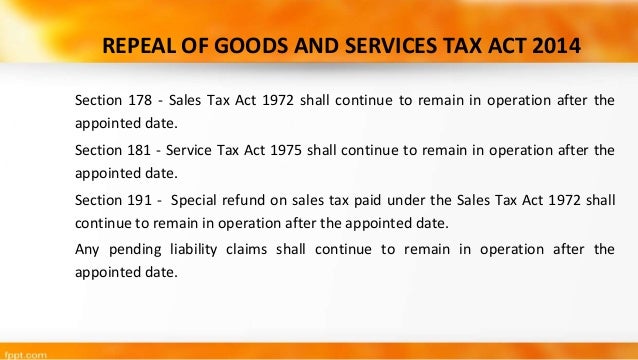

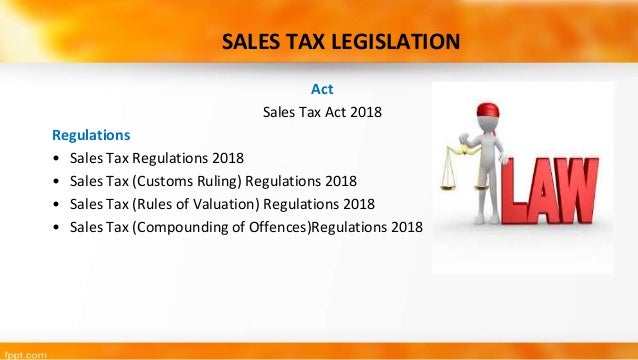

Governed by the sales tax act 2018 and the service tax act 2018 the sales tax was a federal consumption tax imposed on a wide variety of goods while the service tax was levied on customers who consumed certain taxable services.

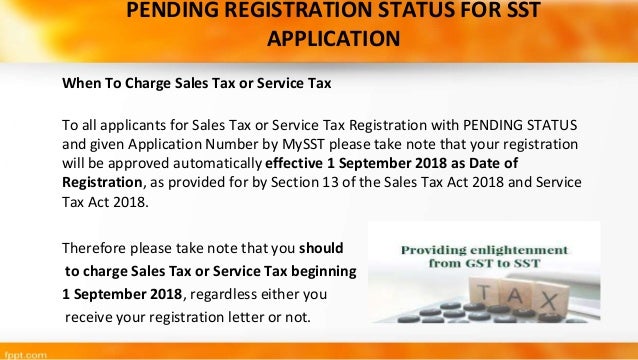

Sale and service tax act 2018. The sales tax act 2018 and service tax act 2018 received royal assent on 24 august 2018 and were gazetted on 28 august 2018. Under section 14 of sales tax act 2018 voluntary registration is allowable to. Rate of service tax for credit and charge cards. Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline.

The contract must state that the contractor is authorized to act in your name and must follow your directions on construction decisions. The sales tax and service tax acts provide for the implementation of a new tax system. Manufacturer of taxable goods and having the annual total sales value below the threshold of rm500 00 within the period of 12 months. Per irs publication 17 your federal income tax page 168.

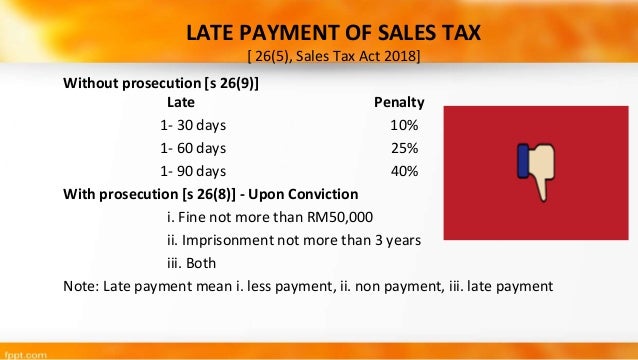

Of the taxable service as determined under section 9 of sta 2018. In this case you will be considered to have purchased any items subject to a sales tax and to have paid the sales tax directly.