Sales And Service Tax Act Malaysia 2018

Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline.

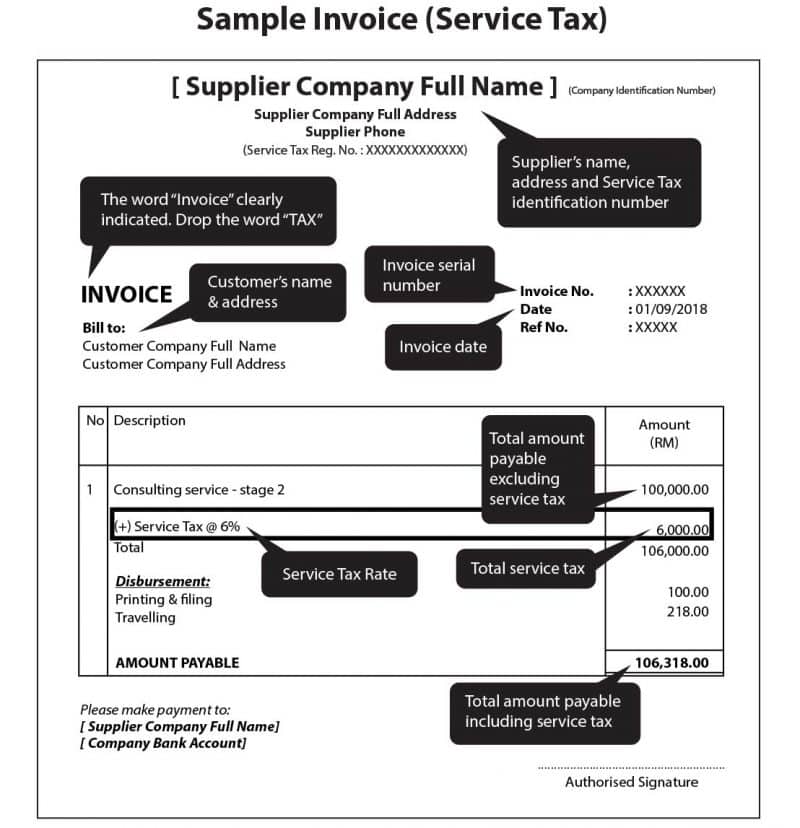

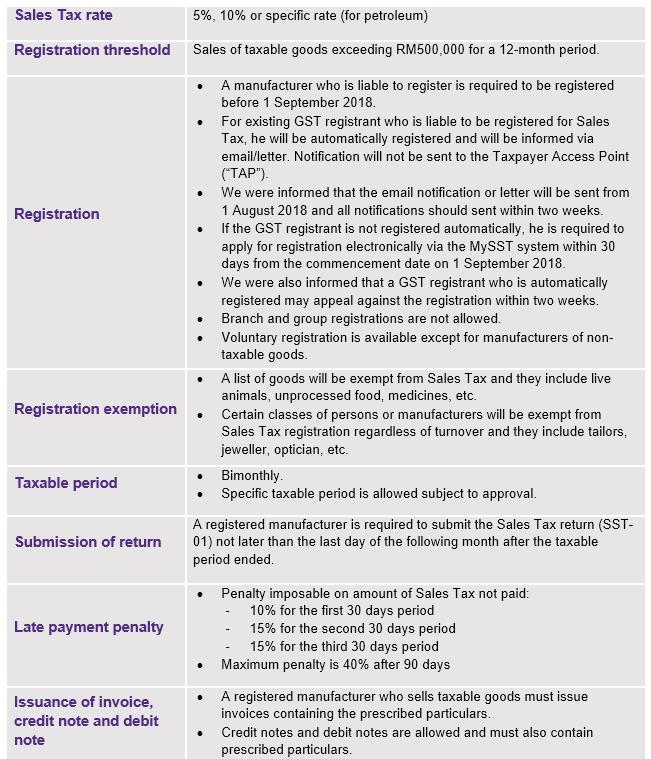

Sales and service tax act malaysia 2018. Government collects sales tax at the manufacturer s level only and the element of sales tax embedded in the price paid by the consumer. The taxable services are as follows. Sec 8 1 sales tax act 2018 a tax to be known assales tax shall be chargedand levied on all taxable goods a manufactured in malaysia by a registered manufacturer and sold used or disposed of by him. In malaysia it is a mandatory requirement that all manufacturers of taxable goods are licensed under the sales tax act 2018.

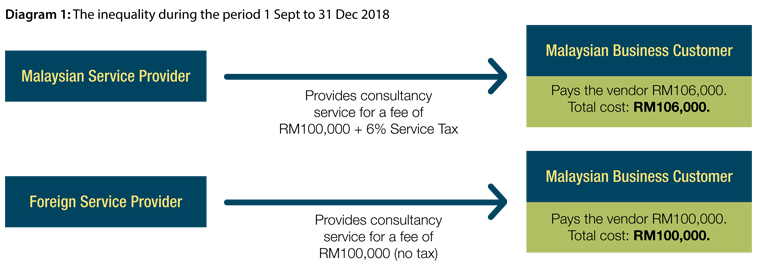

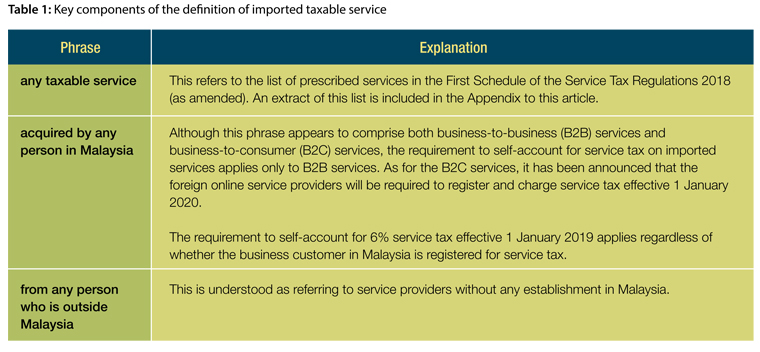

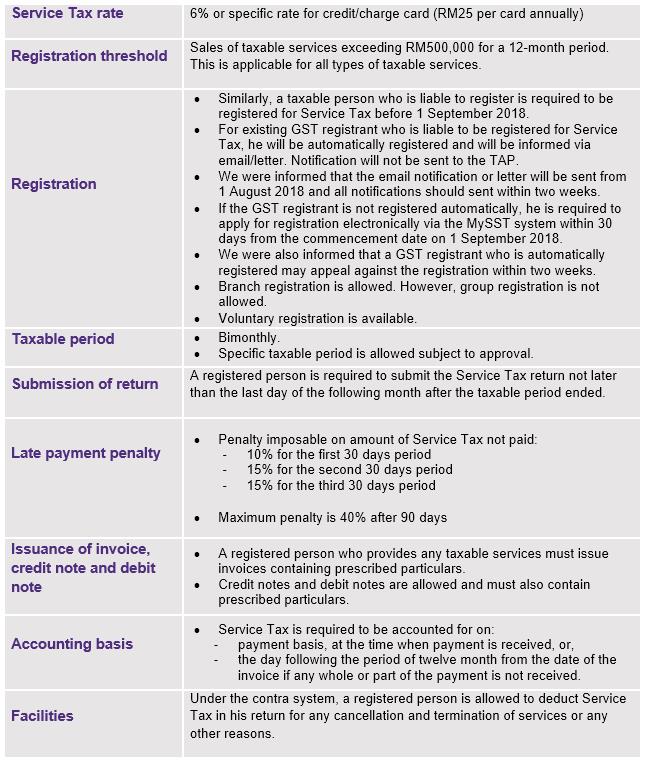

The service tax will stand at 6 and it would be levied on specific prescribed services provided by a taxable person in the course or furtherance of a business in malaysia.