Sales And Service Tax In Malaysia

Sales and services tax sst in malaysia.

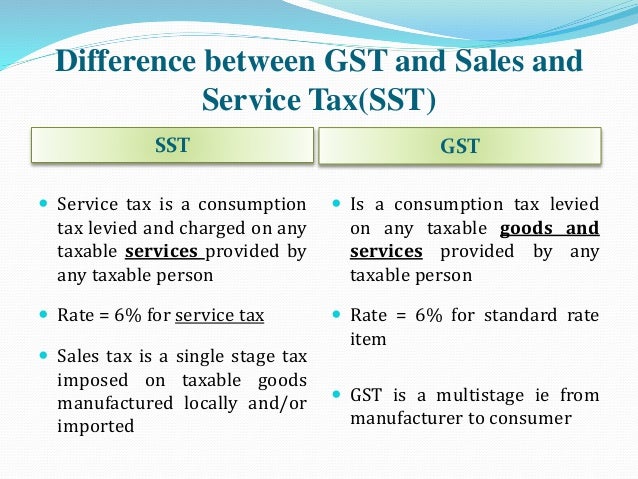

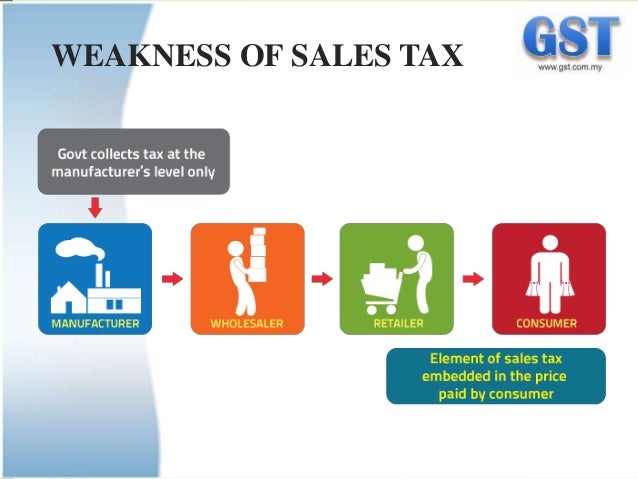

Sales and service tax in malaysia. The sst replaces the existing goods and services tax gst and affects all domestic and import shipments. Service tax is a final tax with no credit mechanism. A service tax that is charged and levied on taxable services provided by any taxable person in malaysia in the course and furtherance of business and a single stage sales tax levied on imported and locally manufactured goods either at the time of. The sst has two elements.

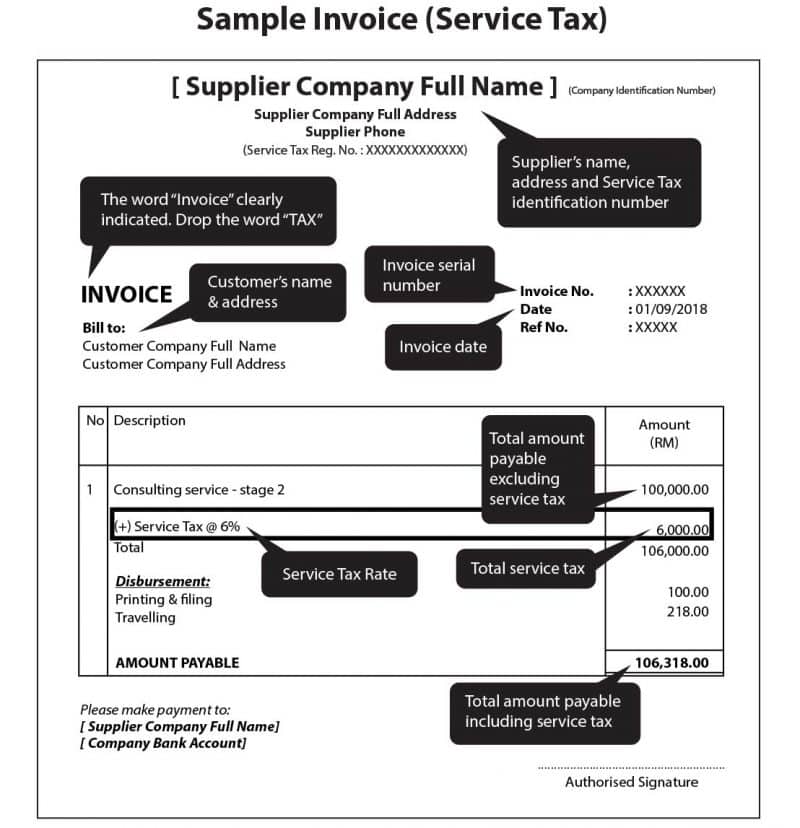

The current rate of service tax is 6. Home core services sales and service tax sst malaysia sales and service tax sst malaysia. Sales and service tax sst has been doing well in malaysia before it was replaced a few years back. In align with the new sales and service tax sst in malaysia we are here to assist you on setup and transition your accounting related to sst compliance.

Taxable services are prescribed in broad categories on a positive list. Before the 6 gst that was implemented in 2015 malaysia levied a sales tax and a service tax. Governed by the sales tax act 2018 and the service tax act 2018 the sales tax was a federal consumption tax imposed on a wide variety of goods while the service tax was levied on customers who consumed certain taxable services. It stands for 10 percent for sales tax while service tax will be charged 6 percent according to the new release from the finance ministry.

The sales and services tax sst has been implemented in malaysia. Therefore any service tax incurred by a business is a final cost.