Sales And Service Tax Sst

If you qualify member states of the streamlined sales tax sst program will cover the cost of registration sales tax calculations returns preparation and state filing and remittance for your business.

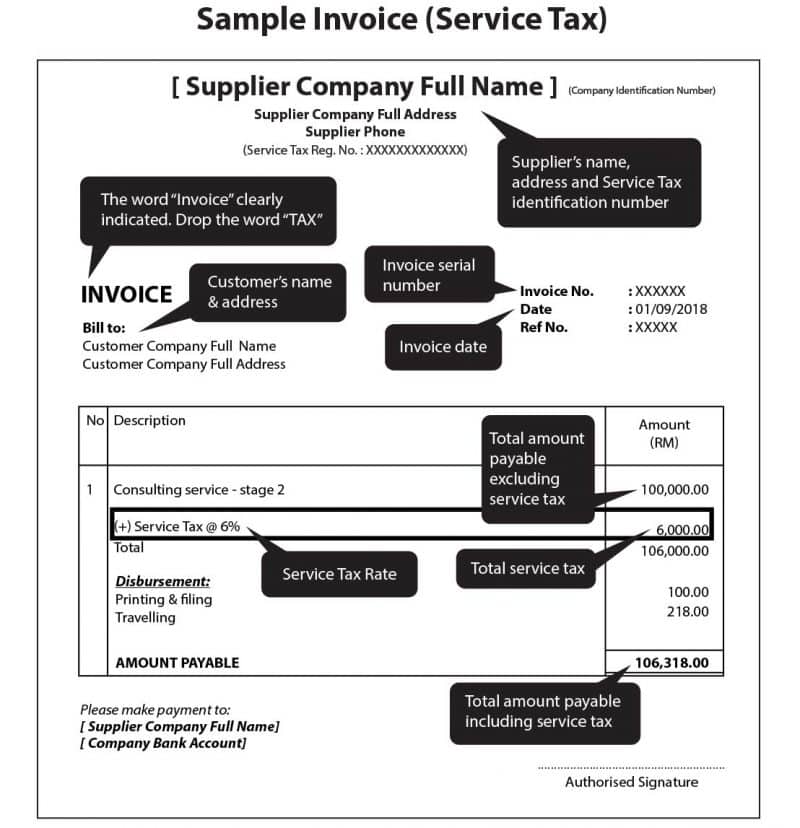

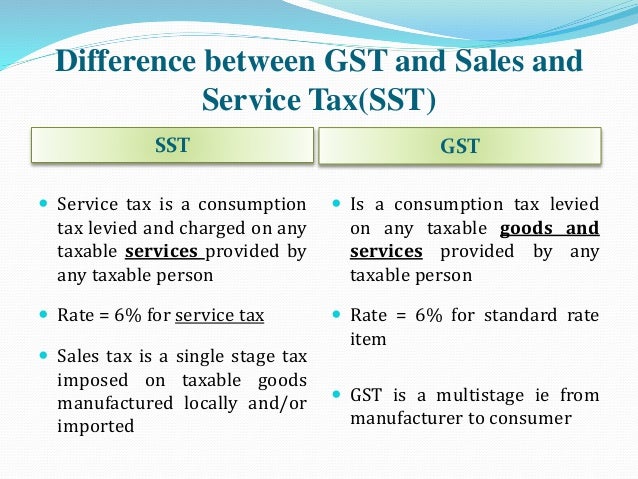

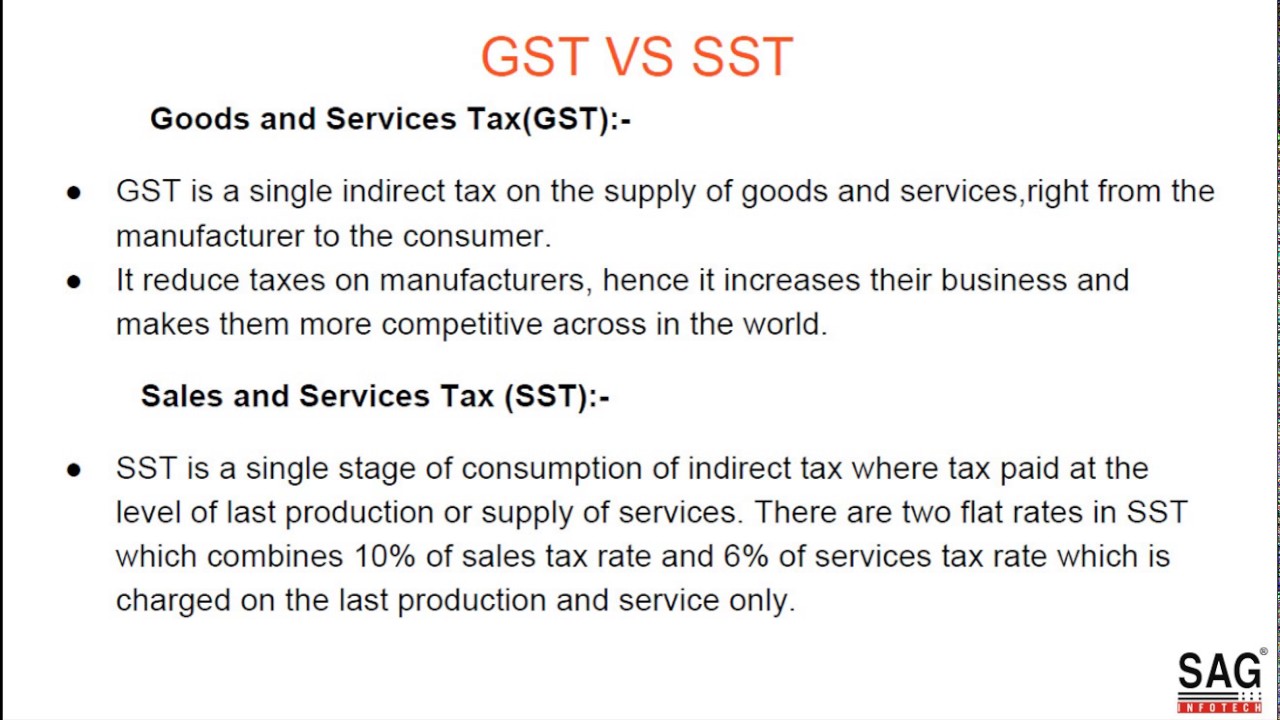

Sales and service tax sst. The rates of sst stand at 10 for sales tax and 6 for services tax that charge on the final production and service only. Just in case you aren t sure about what sst is all about we prepared a quick blog post about the 7 things malaysian business owners need to know about sst. Avalara is an sst certified service provider csp. In the state of north carolina services are not generally considered to be taxable.

Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline. Are services subject to sales tax in north carolina. Under the sst tax regime the range of taxable items and exemptions is lesser if compared with the gst s tax regime. Participating states decided to streamline sales and use tax compliance because the supreme court of the united states had twice ruled in national bellas hess v.

The new sales tax bill governing the sst sales and service tax was officially cleared by dewan negara on aug 20 2018 sst will replace gst and is expected to be fully implemented by september 1 2018. This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst.