Sales And Services Tax Act 2018

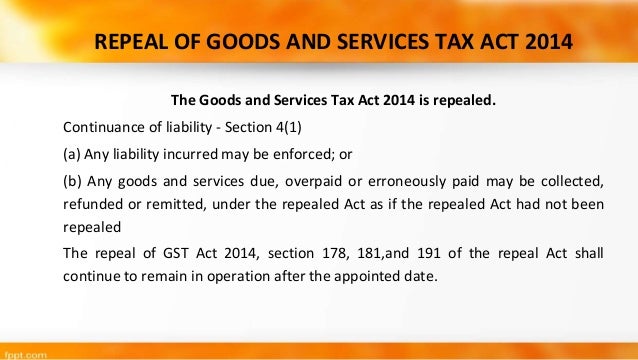

Explanatory statement this bill seeks to repeal the goods and services tax act 2014 act 762.

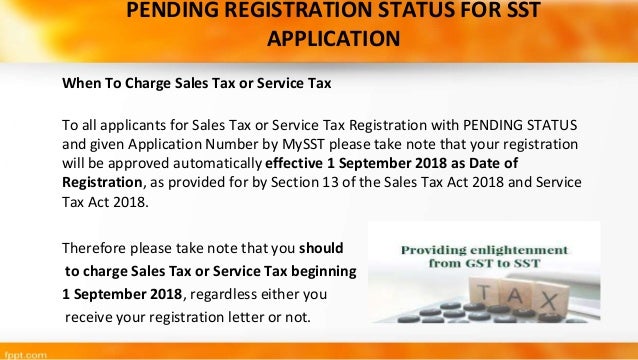

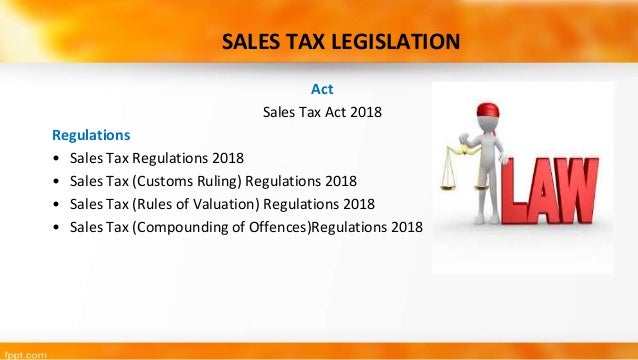

Sales and services tax act 2018. The move of scrapping the 6 gst has paved the way for the re introduction of sst 2 0 which will come into effect in 1 september 2018. Under section 14 of sales tax act 2018 voluntary registration is allowable to. The objective is not to go into substantial details but to enumerate some of the pertinent points. This is due to the implementation of the new tax system namely sales tax and service tax as proposed under the sales tax bill 2018 and service tax bill 2018 which will replace the goods and services tax imposed under act 762.

The ministry of finance mof announced that sales and service tax sst which administered by the royal malaysian customs department rmcd will come into effect in malaysia on 1 september 2018. This publication seeks to provide some basic insights of the service tax act 2018 the act. Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline. The contract must state that the contractor is authorized to act in your name and must follow your directions on construction decisions.

Manufacturer of taxable goods and having the annual total sales value below the threshold of rm500 00 within the period of 12 months. The sales tax and service tax acts provide for the implementation of a new tax system namely the sales and service tax sst that will replace the goods and services tax gst imposed under the goods and services tax act 2014.