Simplified Tax Invoice Malaysia

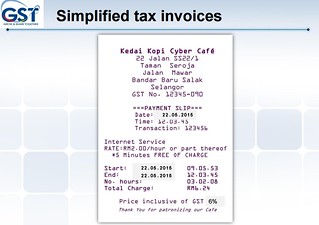

If the recipient wants to claim the full amount of input tax more than rm30 00 then he must request for his name and address to be included in the simplified tax invoice.

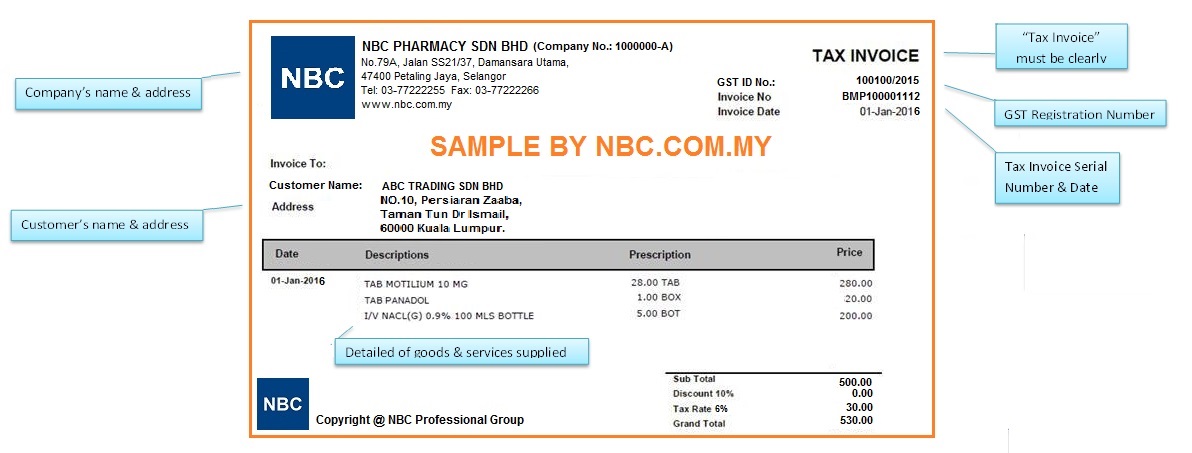

Simplified tax invoice malaysia. Your name address and gst registration number. Relief clauses on invoices. Dg may allow the simplified tax invoice to be issued containing. The date of issuance of the invoice.

If the recipient wants to claim the full amount of input tax more than rm30 00 then he must request for his name and address to be included in the simplified tax invoice. Insurance exempt to the same buyer. Simplified tax invoice which does not have the name and address of the recipient the maximum of input tax to be claimed must not exceed rm30 00 6 gst. The name or trade name address and gst identification number of the.

When the minister grants your customers relief from the payment of all or part of the tax on a taxable supply of goods or services or any importation of goods or classes of goods you should issue tax invoices that include a. You may issue a simplified tax invoice instead of a tax invoice if the total amount payable for your supply including gst does not exceed 1 000. An identifying number e. Date of issue of invoice.

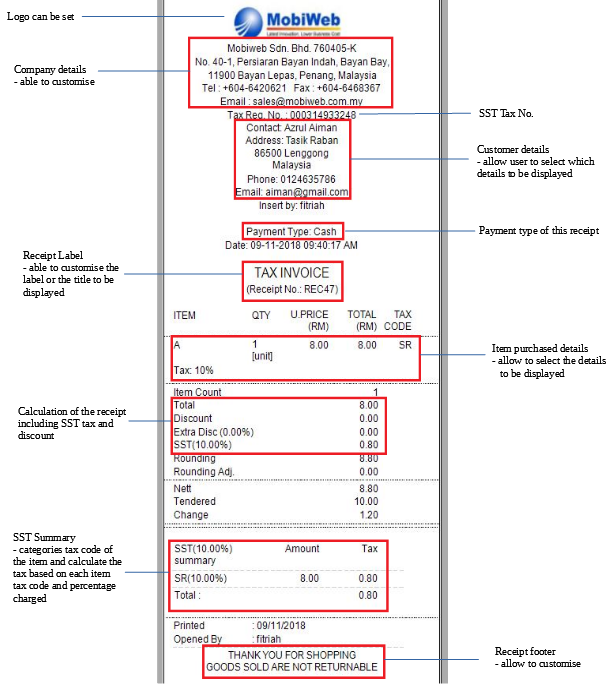

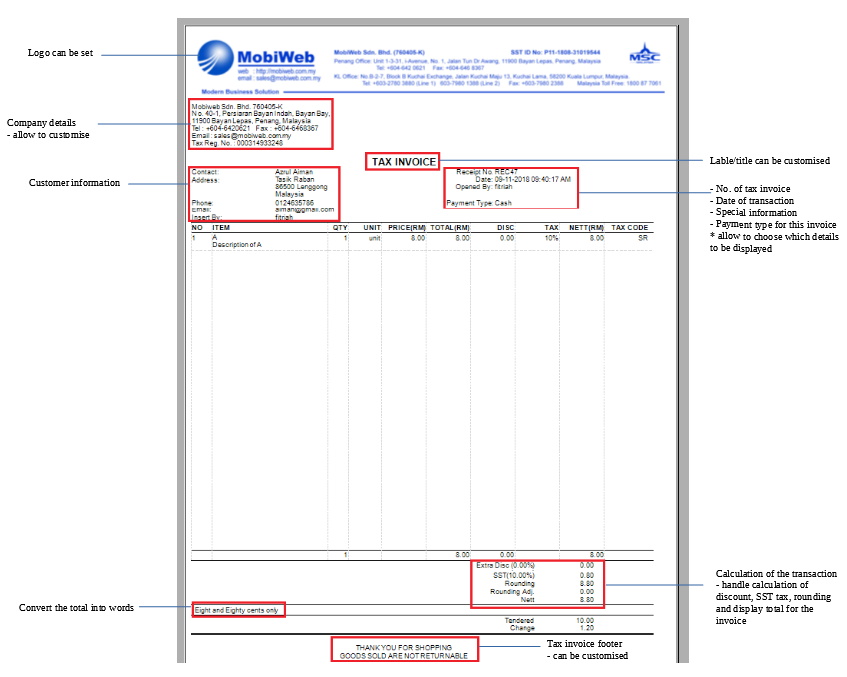

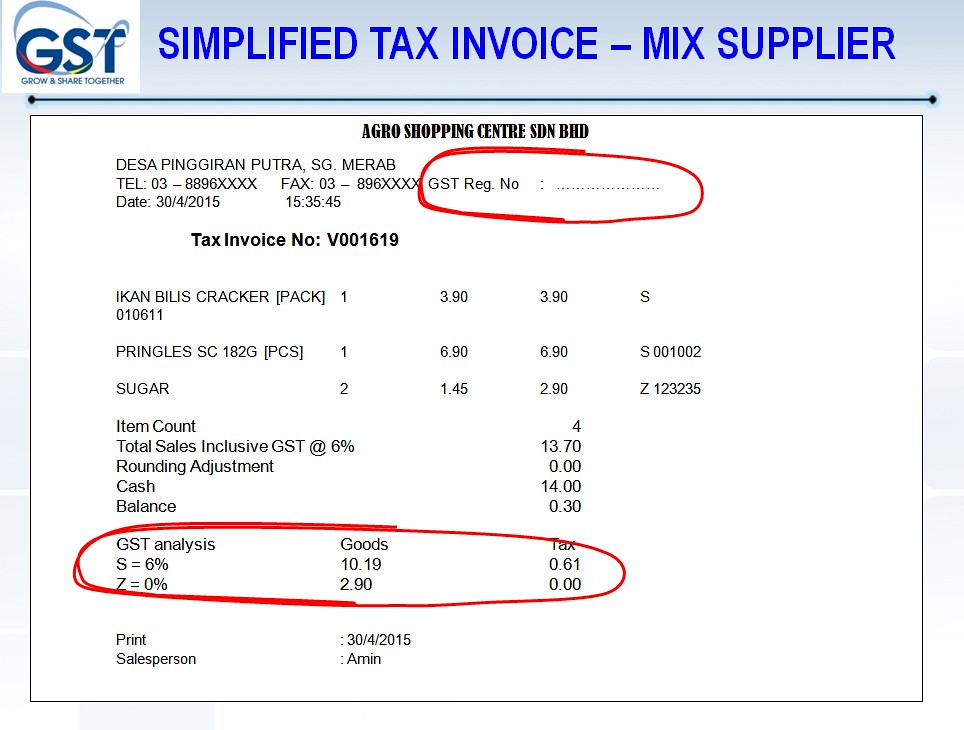

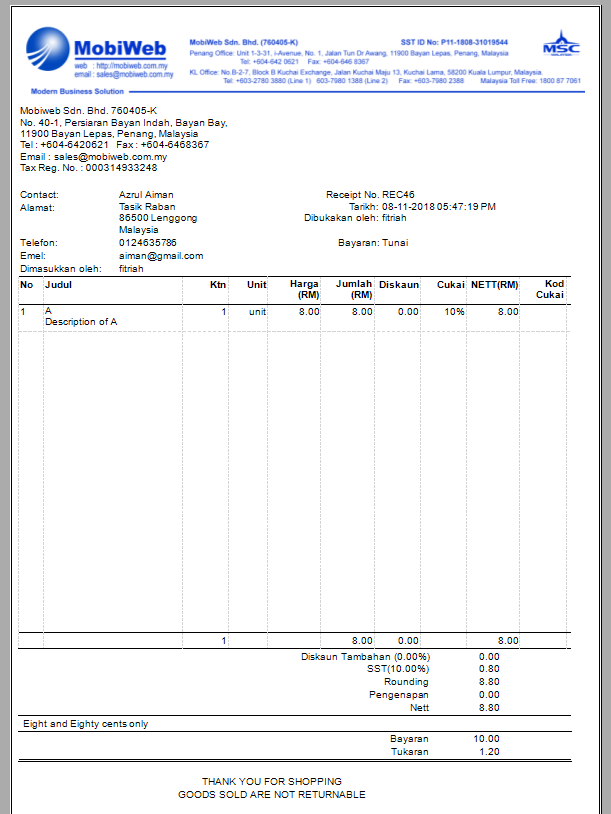

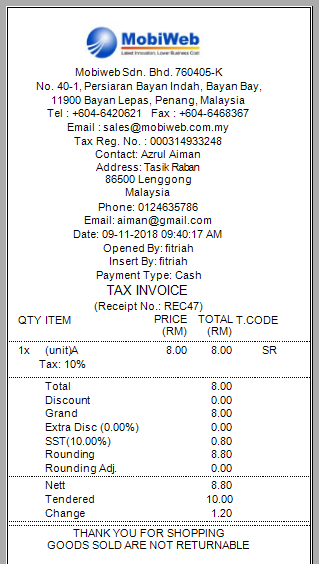

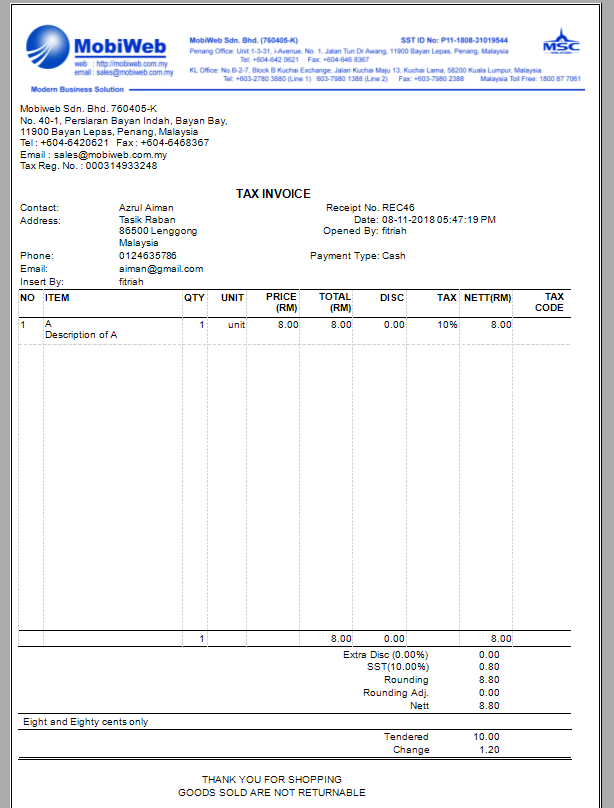

Simplified tax invoice which does not have the name and address of the recipient the maximum of input tax to be claimed must not exceed rm30 00 6 gst. This invoice differs from the sample full tax invoice in that it omits the invoice title and the name and address of the recipient. A sample simplified invoice is provided. In malaysia the goods and services tax gst was replaced with the sales and services tax sst with effect from september 01 2018.

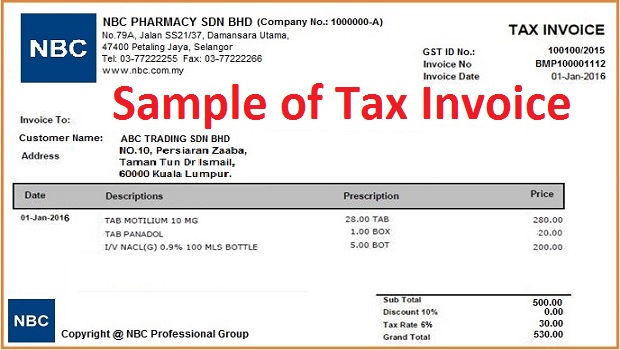

The basic layout of the sheet is similar to the standard bill format shipped with invoice manager but the static text labels are translated using an online tool. The same functionality is available for free text invoices. This malaysia tax invoice template translates all the text inside the printable form into malay. When this occurs the tax invoice full or simplified tax invoice must clearly distinguish between the various supplies and indicate separately the applicable values and the tax charged if any on each supply serial no.

Simplified tax invoice can be used by the gst registrant to claim itc provided the value of the invoice inclusive gst does not exceed rm500. Tax invoicing in malaysia provides an electronic invoicing solution that includes receiving validating transforming and transmitting tax invoices to buying organizations through ariba network. The name or trade name address and gst identification number of the supplier. Simplified tax invoice can be used to claim input tax credit.

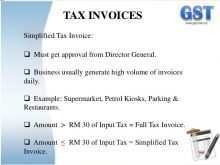

Simplified tax invoice an invoice that does not contain all the particulars as required in the standard tax invoice and subject to the approval of the director general. If the recipient wants to claim the full amount of input tax more than rm30 00 then he must request for his name and address to be included in the simplified tax invoice. Description quantity unit price rm total rm 1. Dg may allow the simplified tax invoice to be issued containing.

A simplified tax invoice only requires the following information.