What Is Gst In Malaysia

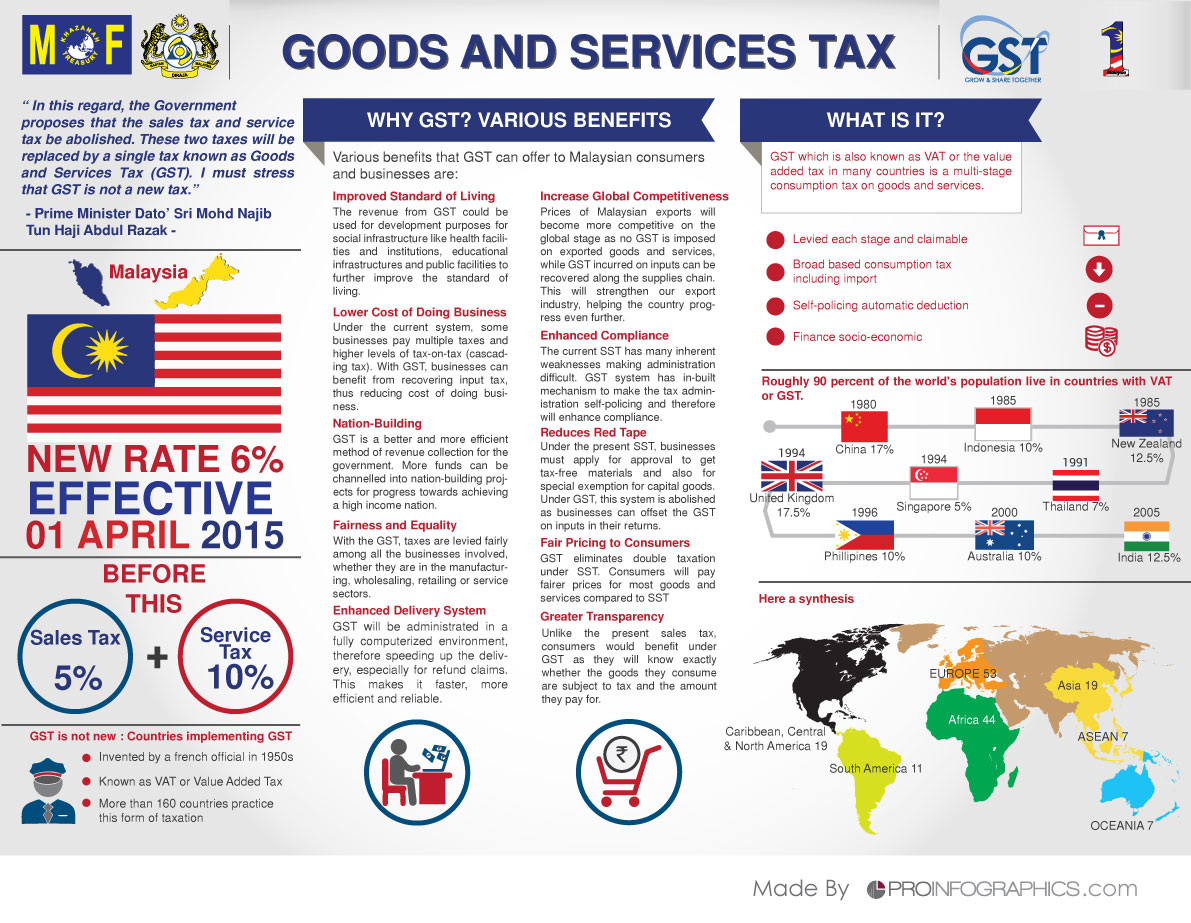

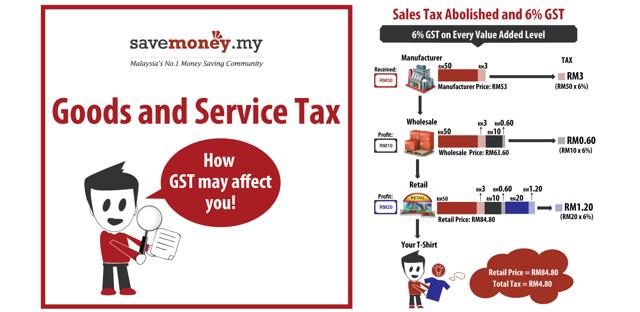

The basic fundamental of gst malaysia is its self policing features which allow the businesses to claim their input tax credit by way of automatic deduction in their accounting system.

What is gst in malaysia. Responsibilities of registered person. The sales tax and service tax sst. Gst is a broad based consumption tax covering all sectors of the economy i e all goods and services made in malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the minister of finance and published in the gazette. Gst in malaysia is proposed to replace the current consumption tax i e.

Gst is a broad based consumption tax covering all sectors of the economy i e all goods and services made in malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the minister of finance and published in the gazette. Malaysia s recent addition of a goods and service tax gst which was passed by the government during the third quarter of 2011 but delayed until april 2016 has been the cause of much confusion within asean s second most developed economy. The goods and services tax gst is an abolished value added tax in malaysia. Gst is a broad based consumption tax covering all sectors of the economy i e all goods and services made in malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the minister of finance and published in the gazette.