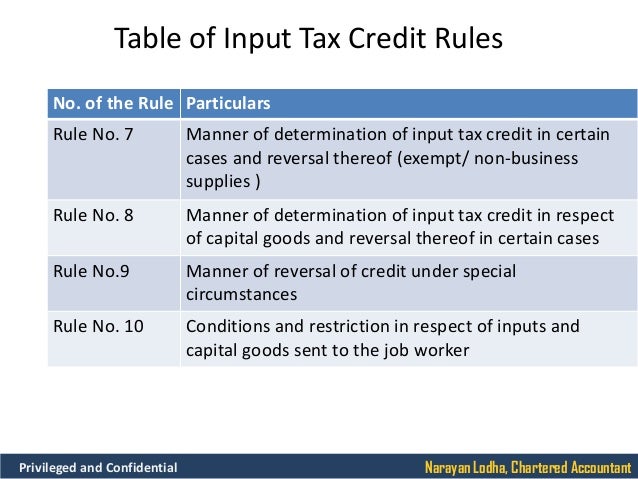

Input Tax Credit Rules Under Gst

In turn the sales are more within the state when compared to outside the state.

Input tax credit rules under gst. As per section 16 1 of cgst act 2017 every registered taxable person shall subject to such conditions and restrictions as may be prescribed and within the time and manner specified in section 49 be entitled to take credit of input tax charged on any supply of goods or services to him which are used or intended to be used in the course or furtherance of his business and the said amount. This is called a gst credit or an input tax credit a credit for the tax included in the price of your business inputs. This is input tax credit utilization of gst which enables to overcome challenges such as cascading tax prevalent under previous tax regime. Possession of a tax invoice or debit note or document evidencing payment.

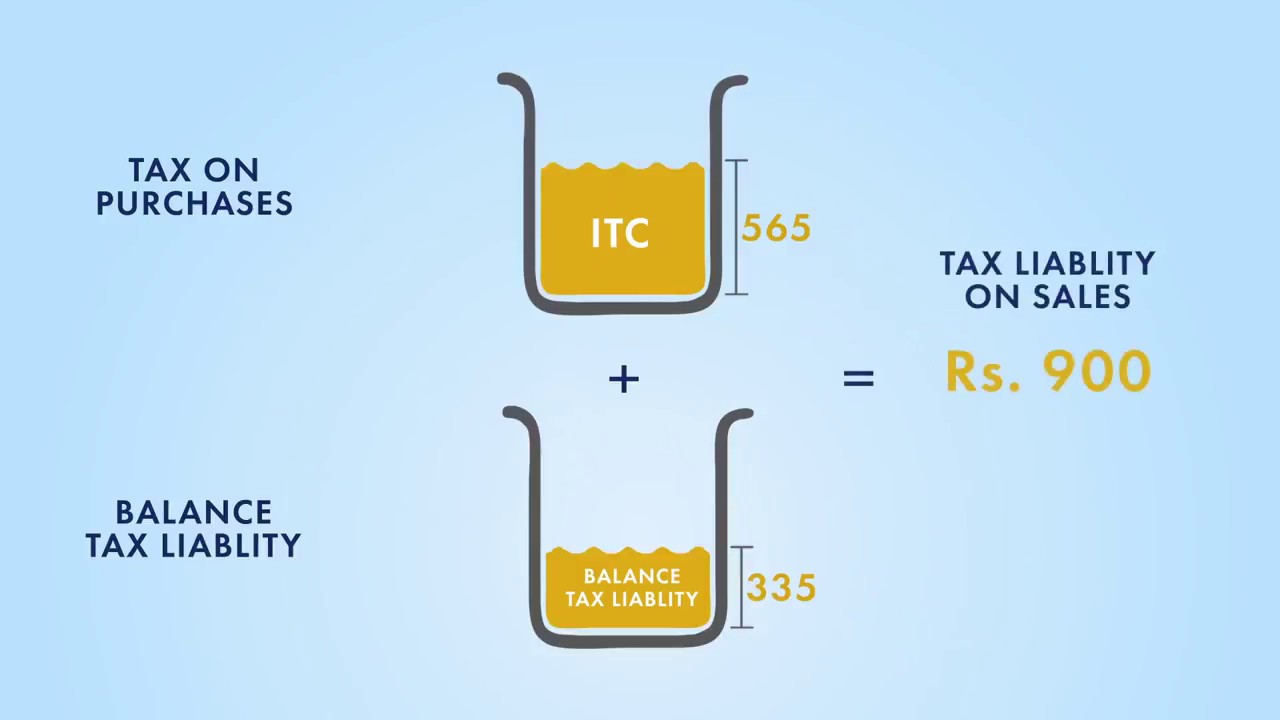

Follow the links below for more information about. A registered person will be eligible to claim input tax credit itc on the fullfilment of the following conditions. Under gst regime the taxpayer paying gst on inputs can claim the credit for tax paid on inputs and utilize the same towards the liability to pay gst on output. The amount of eligible credit would be calculated in a manner to be prescribed under gst law and rules.

Receipt of goods and or services. The input tax credit of goods and service attributable to only taxable supplies can be taken by the registered taxable person. Gst act and rules made there under does not restrict the recipient from claiming the input tax credit when consideration is paid through book adjustment subject to the conditions and restrictions as maybe prescribed and in the manner specified in sections 16 and 49 of the gst act. Input tax credit can be claimed on exports zero rated.

The new gst offset rules mandates for complete utilisation of igst input credit before using the cgst or sgst input credit. It is important to note that credit on capital goods also would now be permitted on a proportionate basis. There are some condition that are required to be fulfilled by the entity to claim input tax credit a person must be registered in gst. The following conditions have to be met to be entitled to input tax credit under the gst scheme.

One must be a registered taxable person. You can claim a credit for any gst included in the price of any goods and services you buy for your business. He is having tax invoiceor debit note in his possession. Suppliers must pay the tax liability on supplies made during a month by 20 th of the next month.

In illustration 2 we can observe that the taxpayer has a higher credit due to interstate purchases when compared to the intrastate purchase. Apportionment of credit and blocked credits section 17. Input tax credit under gst conditions to claim.